Market Mispricing of Inflation Risks Despite Low Outlook, Warns Citigroup.

TL;DR Summary

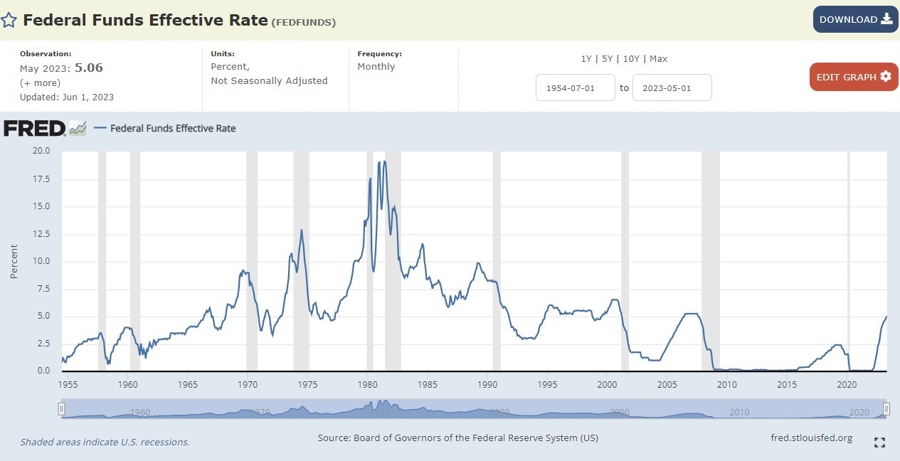

Citi warns that markets are not pricing in the downside risks for inflation ahead of the May inflation release, despite two consecutive lower-than-forecast CPI prints. Inflation expectations are higher than at the beginning of 2021, despite tighter financial conditions, lower year-over-year inflation, and higher unemployment and jobless claims. Citi predicts that core inflation will fall below 0.4% m/m in May for the first time since November. While analysts predict that higher than expected core inflation will trigger a rate hike from the Federal Open Market Committee, Citi believes that the risk is the other way around.

- Citi says markets mispricing downside risks for inflation heading into the May inflation ForexLive

- Inflation outlook hits two-year low in latest New York Fed survey CNBC

- NY Fed: Inflation outlook hits two-year low CNBC Television

- Citigroup Warns Bond Traders Are Misreading Inflation Ahead of CPI Yahoo Finance

- Americans haven’t been this optimistic about inflation in two years CNN

Reading Insights

Total Reads

0

Unique Readers

4

Time Saved

0 min

vs 1 min read

Condensed

41%

163 → 96 words

Want the full story? Read the original article

Read on ForexLive