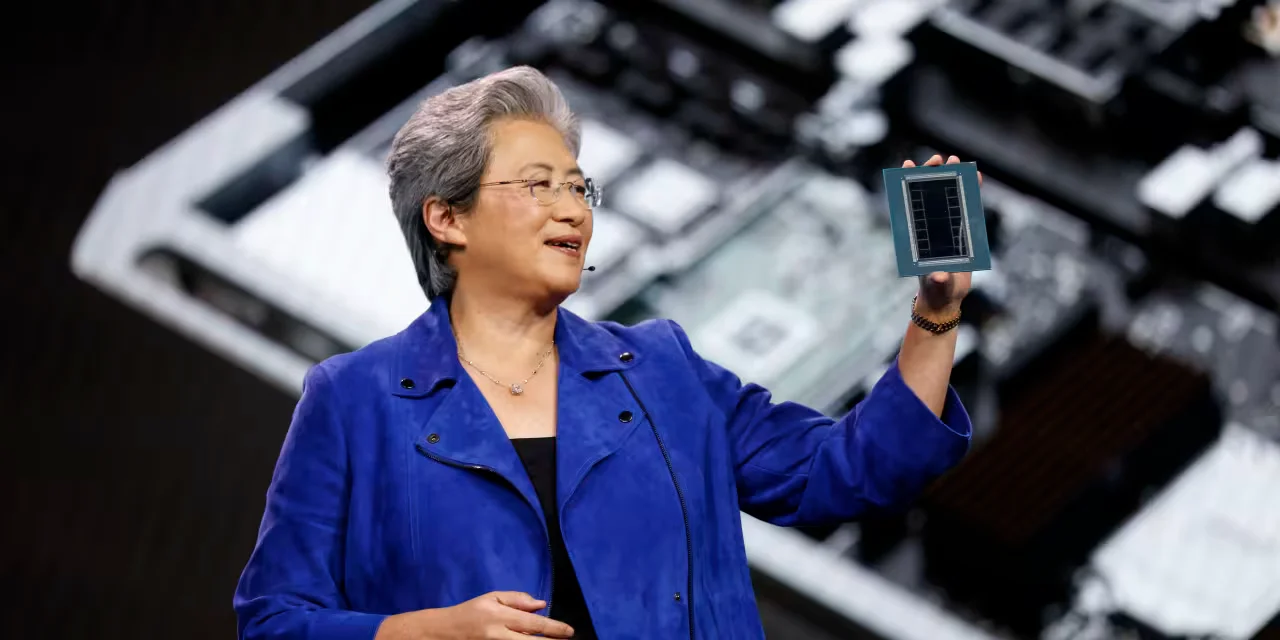

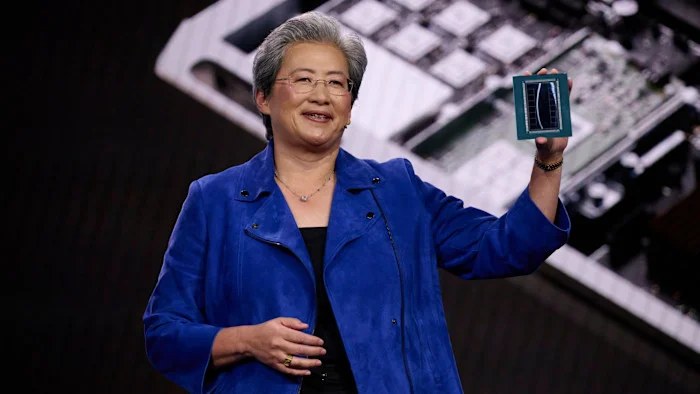

Meta and AMD strike multi-billion AI chip deal, eye a stake in the chipmaker

Meta has struck a multibillion-dollar deal with AMD to buy 6 gigawatts of custom MI450 AI chips to accelerate its AI models, while AMD granted Meta a performance-based warrant to buy up to 160 million AMD shares at $0.01, with the first tranche due in H2 as the initial gigawatt ships; the arrangement could yield about a 10% stake in AMD over time, echoing OpenAI’s deal, and sent AMD stock higher pre-market. Meta plans to spend up to $135bn on AI infra this year and seeks to diversify beyond Nvidia, using the chips mainly for inference workloads that require 6GW; the warrant expires Feb 2031 and final tranche triggers at $600 per share.