US Credit Market Faces Mixed Signals Amid Economic Slowdown

More high-grade borrowers in the US are at risk of credit downgrades as the economy slows, according to the Financial Times.

All articles tagged with #credit downgrade

More high-grade borrowers in the US are at risk of credit downgrades as the economy slows, according to the Financial Times.

New York Community Bank (NYCB) has been hit with its third credit downgrade due to concerns about its exposure to commercial real estate (CRE) and a surprise loss, leading to a plunge in its stock price. The bank's management is considering selling off loans in its CRE portfolio and shrinking its balance sheet to shore up its financial strength. Treasury Secretary Janet Yellen expects additional stress and financial losses in the CRE market, while NYCB has set aside more capital to meet regulatory requirements. NYCB, which acquired failed banks during last year's regional banking crisis, has seen its stock fall over 59% in the last month.

New York Community Bancorp (NYCB) faced its third credit-rating cut due to concerns over its exposure to commercial real estate (CRE), prompting rating agencies to downgrade its credit rating. The bank's shares have fallen around 60% since last week, and its management is considering selling off loans in its CRE portfolio or shrinking its balance sheet to bolster its financial strength. The worries over CRE exposure have also affected lenders in Europe and Asia, with concerns about potential global contagion. Despite these concerns, there is little evidence that banking worries are denting confidence in the broader stock market, and U.S. Treasury Secretary Janet Yellen expects additional stress on banks and some financial losses from weakness in the U.S. commercial real estate market.

New York Community Bancorp (NYCB) is working to reassure investors after a 60% stock slide and a credit downgrade by Moody's. The bank's CEO emphasized the stability of its deposits and liquidity, and the appointment of a new executive chairman. NYCB's troubles stem from its response to a 2023 crisis, which led to higher regulatory standards and the recent decision to cut its dividend and increase loan loss provisions. Moody's cited financial, risk-management, and governance challenges, particularly related to the bank's exposure to commercial real estate and dependence on wholesale funding.

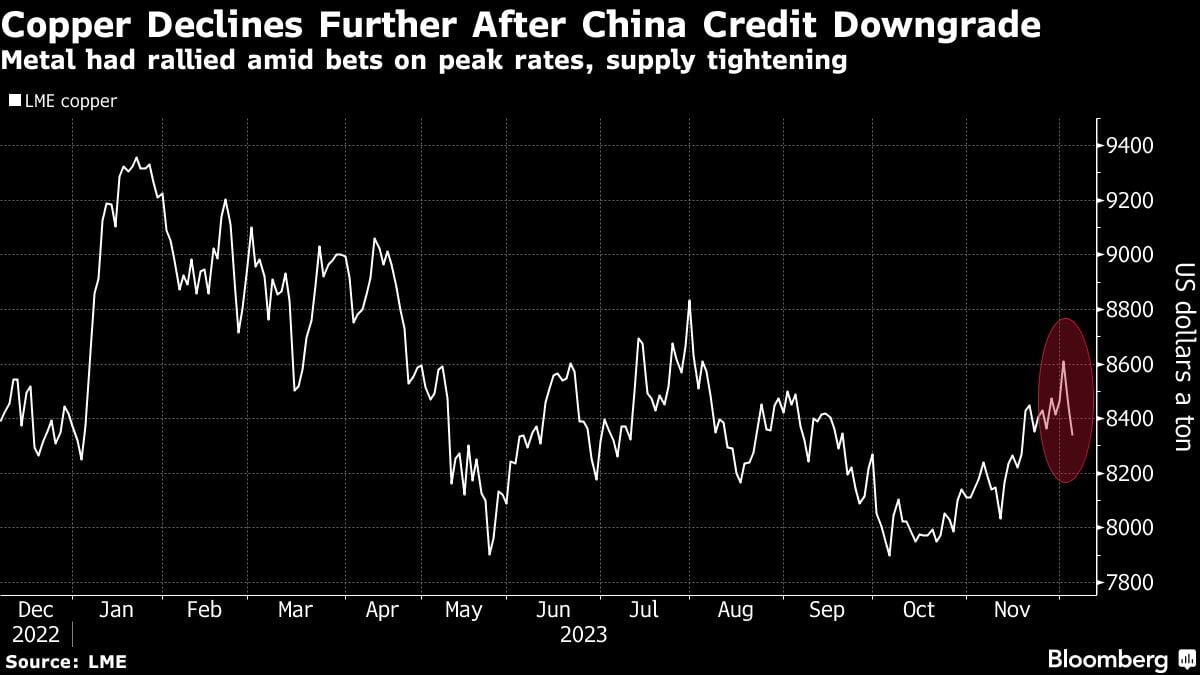

Copper futures fell as concerns about China's economic outlook and rising debt levels led Moody's to cut its credit outlook for Chinese sovereign bonds to negative. The downgrade has overshadowed optimism about potential interest rate cuts by the US Federal Reserve, which could boost demand. The sentiment issue affecting demand in China has caused a decline in copper prices, despite expectations of tighter global supply. However, if the government provides support to the economy, particularly the property market, it could help revive demand for commodities. Copper futures on the London Metal Exchange dropped 1.2% following the news.

Fitch Ratings has warned that it may downgrade the credit ratings of over a dozen US banks, including major Wall Street lenders, due to downward pressure on the country's sovereign debt rating, gaps in regulatory framework, and uncertainty over interest rates. Another downgrade of the industry's score would force Fitch to reassess ratings on more than 70 US banks, potentially impacting banking giants like JPMorgan Chase and Bank of America. This comes after Moody's recently downgraded the ratings of 10 banks and placed six banking giants on review for potential downgrades, citing concerns over interest rates and commercial real estate risks.

Fitch Ratings has warned that it may downgrade the credit rating of the U.S. banking sector operating environment, potentially leading to credit downgrades for over 70 individual banks, including major institutions like JP Morgan Chase and Bank of America. If downgraded, banks would face higher borrowing costs, which would likely be passed on to consumers in the form of higher interest rates. This comes as banks are already under pressure from the Federal Reserve's anti-inflation interest rate hikes, which have reduced the value of their assets.

American voters express dissatisfaction and lack of surprise over the recent credit downgrade of the US economy by ratings agency Fitch. Voters criticize the erosion of governance, rising deficits, and loose monetary policy, which they believe have contributed to the nation's heavy debt burden. US Treasury Secretary Janet Yellen defended the Biden administration's economic policies, stating that credit conditions have improved. However, voters express concerns about inflation and the overall downward spiral of the economy, which could influence their candidate choices in the 2024 elections.

Asia-Pacific markets were mixed as Wall Street experienced a sell-off following the downgrade of the United States' credit rating. Hong Kong's Hang Seng index dropped, while mainland Chinese markets rebounded. Japan's Nikkei 225 tumbled, leading losses in the region. South Korea's Kospi fell, but the Kosdaq rose. Australia's S&P/ASX 200 slid as the country's trade balance came in above expectations. In other news, Nintendo reported a surge in quarterly profits, and AMD sees India as crucial for its product development. China's services sector expanded for the seventh consecutive month, while Hong Kong's business activity contracted for the first time in 2023. Additionally, the cost of hedging against a market downturn is at a 15-year low, and Kakao's net profit slumped in the second quarter.

Fitch Ratings has downgraded the U.S. government's credit rating from "AAA" to "AA+" due to concerns over rising federal debt and political dysfunction. The decision came as a shock to senior Biden aides who were optimistic that their successful handling of a debt ceiling standoff earlier this year would prevent a downgrade. The Biden administration has emphasized its efforts to improve governance and reduce the deficit, but Fitch cited the growing debt burden and repeated debt limit standoffs as reasons for the downgrade. The rising debt poses a political challenge for President Biden, and experts warn of long-term fiscal threats if Congress fails to address the issue.

The stock market experienced a decline as the Dow Jones and Nasdaq both slid, with the Nasdaq Composite leading the way. The drop in stocks came after the U.S. credit was downgraded and amid lackluster earnings reports. Chip stocks also saw a decline following Advanced Micro Devices' second-quarter earnings report. Treasury yields rose, with the 10-year Treasury yield reaching its second-highest closing level this year. Additionally, oil prices fell, and Tupperware's stock continued its volatile ride.

Fitch Ratings warned that it could still downgrade the US credit rating despite Congress passing a bill to raise the debt ceiling and cut spending. The repeated political standoffs over the federal government's borrowing limit have lowered confidence in governance on fiscal and debt matters. A credit downgrade could drive up borrowing costs for consumers, businesses, and governments, tightening credit conditions at a time when the economy is already at risk of recession. Fitch intends to resolve its negative watch by the end of September.

First Republic Bank's credit rating was downgraded by Fitch Ratings and S&P Global Ratings due to concerns about potential deposit outflows despite federal intervention. The bank's shares tumbled 16% in midday trading. Both credit ratings firms pointed to the large amount of uninsured deposits at First Republic, which has a high concentration of deposits among wealth clients in coastal markets in the United States.

First Republic Bank has been downgraded to 'junk' status by S&P Global Ratings due to concerns over further deposit flight that could hurt its profitability. The bank's deposit base is more concentrated than most large regional banks, with a portion above the FDIC's $250,000 threshold at risk of withdrawal. Fitch also downgraded the bank's debt rating.