China's Credit Downgrade Sends Shockwaves Through Global Markets

TL;DR Summary

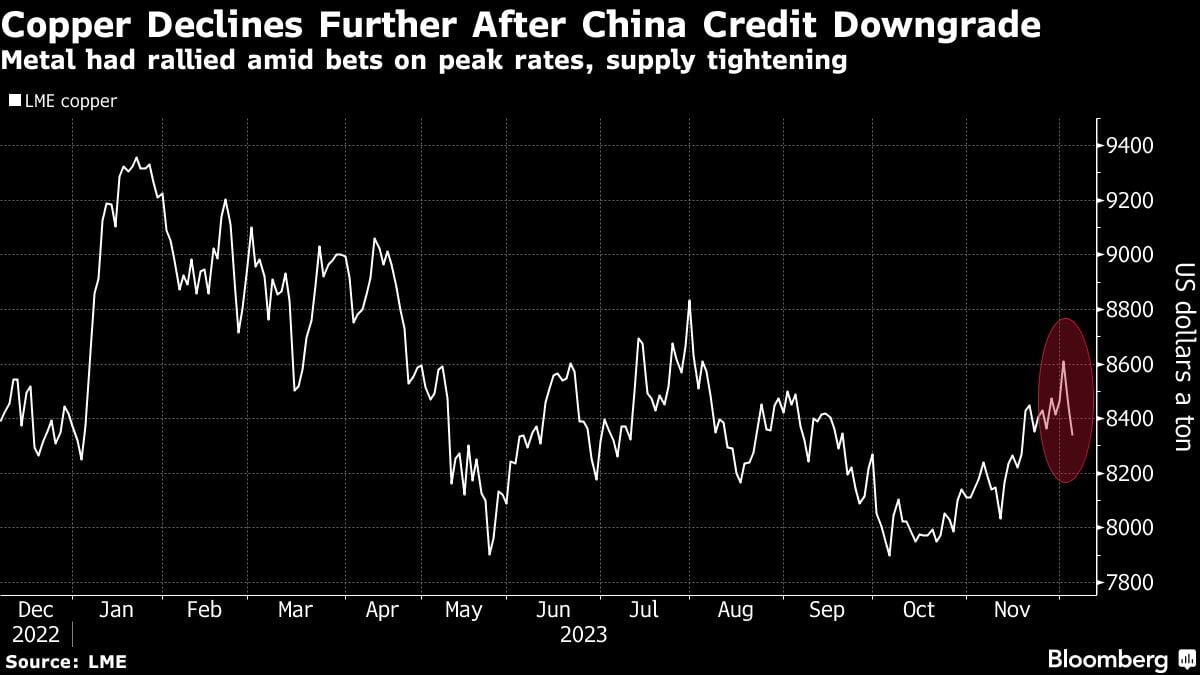

Copper futures fell as concerns about China's economic outlook and rising debt levels led Moody's to cut its credit outlook for Chinese sovereign bonds to negative. The downgrade has overshadowed optimism about potential interest rate cuts by the US Federal Reserve, which could boost demand. The sentiment issue affecting demand in China has caused a decline in copper prices, despite expectations of tighter global supply. However, if the government provides support to the economy, particularly the property market, it could help revive demand for commodities. Copper futures on the London Metal Exchange dropped 1.2% following the news.

- Copper Futures Dragged Down by China's Credit Downgrade Yahoo Finance

- China's Rising Debt Spurs Moody's to Lower Credit Outlook The New York Times

- China's credit rating downgraded, here's what it means for Tesla, Apple, Nike, LVMH Yahoo Finance

- Stock Index Futures Slip Ahead of U.S. JOLTs Report, China Credit Outlook Downgrade Weighs Barchart

- Morning Bid: China rating alarm still ringing Reuters

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

1 min

vs 2 min read

Condensed

75%

394 → 97 words

Want the full story? Read the original article

Read on Yahoo Finance