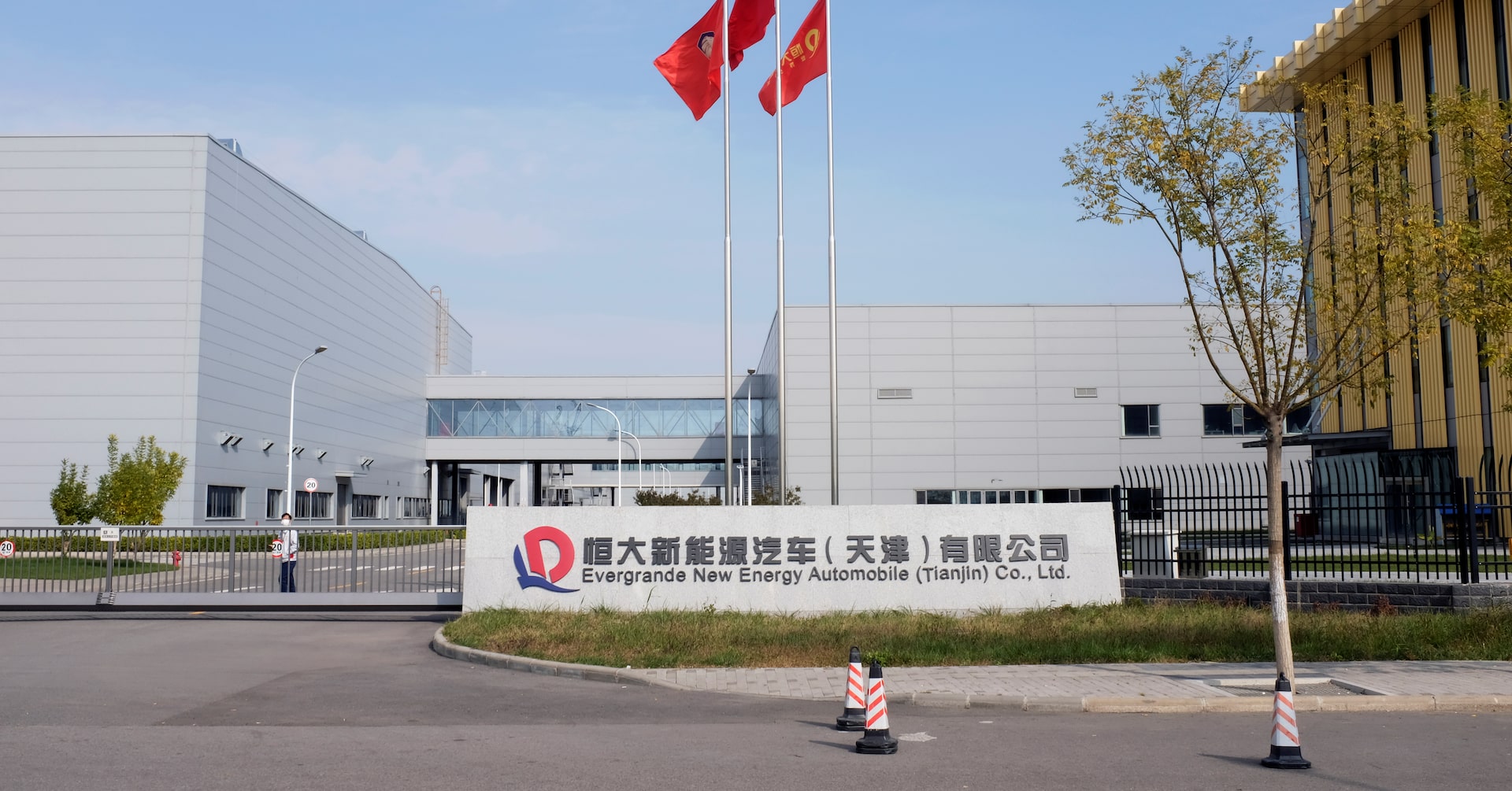

Evergrande's Delisting Marks the End of an Era for China's Property Sector

China Evergrande, once China's largest property developer, is set to be delisted from the Hong Kong Stock Exchange after collapsing under over $300 billion in debt, leaving unfinished projects, thousands of homebuyers, and creditors worldwide in financial limbo, with ongoing legal efforts to recover assets and hold former executives accountable.