Business And Finance News

The latest business and finance stories, summarized by AI

Featured Business And Finance Stories

"Paramount's Stock Surges on Sony-Apollo Buyout Talks"

Paramount Global shares surged 13% as Sony Pictures Entertainment considers joining Apollo Global Management's bid for Paramount, with investors showing enthusiasm for the potential scenario. Meanwhile, Skydance Media, backed by RedBird Capital, is in exclusive negotiations with Paramount's controlling shareholder, National Amusements. The market value of Paramount is around $8.5 billion, and there are ongoing uncertainties about the shape of potential deals, with Apollo making separate overtures for Paramount Pictures. The ultimate direction of a deal remains uncertain, with Shari Redstone's stake and potential litigation posing challenges.

More Top Stories

"Taylor Swift Joins Bernard Arnault at the Top of Forbes' Billionaires List"

New York Post •1 year ago

E.l.f. Beauty Surpasses Expectations, Raises Full-Year Outlook

Yahoo Finance•2 years ago

More Business And Finance Stories

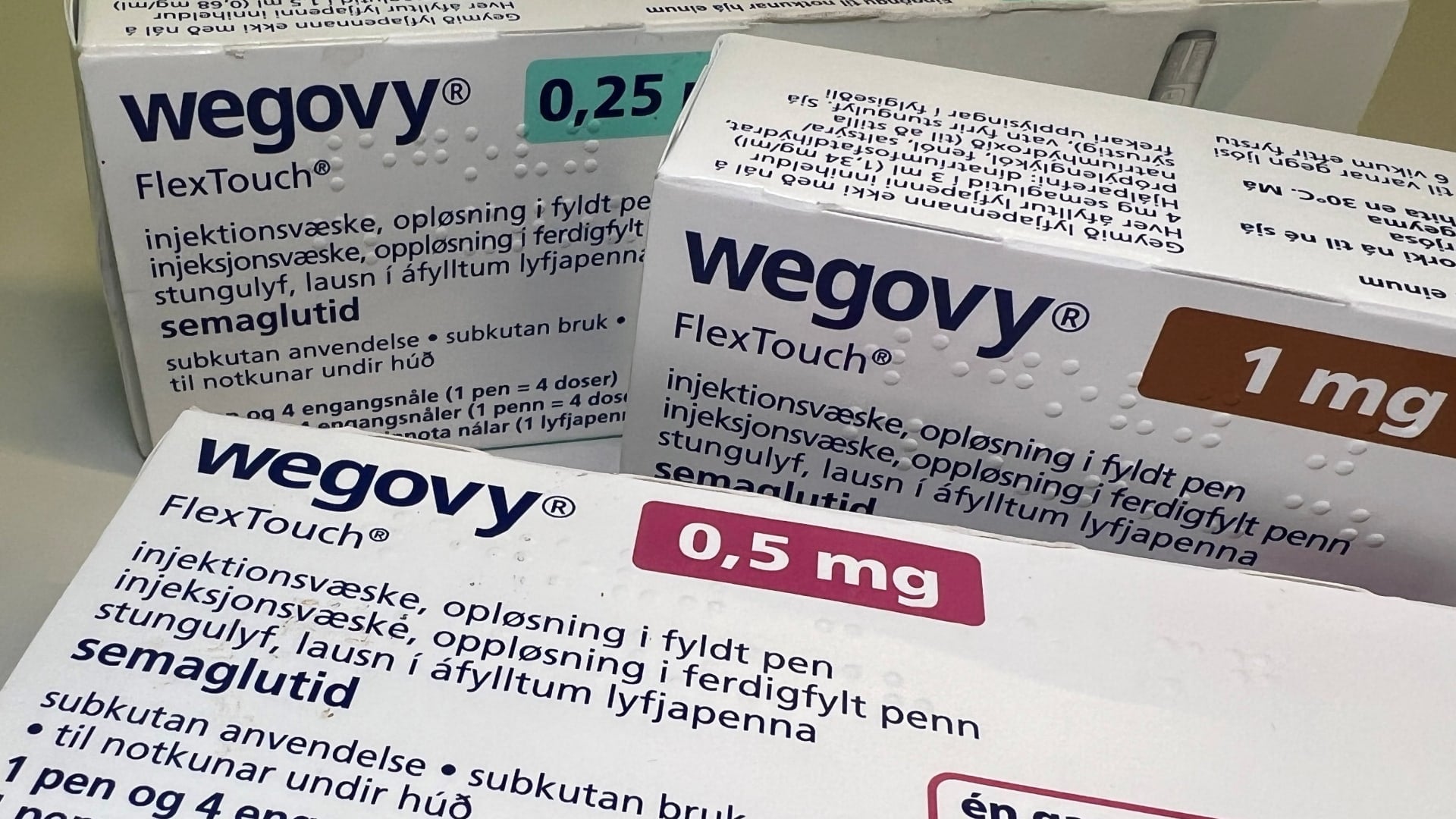

Novo Nordisk's Parent Acquires Catalent for $16.5 Billion to Expand Wegovy Production

Novo Nordisk's parent company is set to acquire drug manufacturer Catalent for $16.5 billion, aiming to enhance the supply of weight-loss drug Wegovy and diabetes shot Ozempic. The deal includes the purchase of three manufacturing sites from Catalent's parent company, Novo Holdings, and is expected to close by the end of 2024. Novo Nordisk anticipates the acquisition to gradually increase its filling capacity from 2026 onwards. The move comes as Novo Nordisk seeks to bolster its drug manufacturing capabilities amid rising competition in the weight loss drug market, with the deal receiving support from activist investor Elliott Investment Management.

"Boeing Headwinds: Impact on United and Alaska Airlines Earnings"

United Airlines warns of first-quarter 2024 outlook impact due to grounding of Boeing 737 Max 9 jets for inspections, prompting discussions on potential implications for other airlines like JetBlue, Spirit Airlines, and Alaska Airlines. Expert Mike Boyd suggests that Boeing's commitments until 2030 make it difficult for Airbus to fill the gap, while also commenting on the blocked JetBlue-Spirit merger and the challenges faced by Alaska and JetBlue due to fleet issues.

"Macquarie Sets New Record with €8bn Europe Infrastructure Fund"

Macquarie has successfully raised a record €8 billion for its Europe infrastructure fund, marking a significant achievement in the fundraising landscape. The substantial amount raised reflects strong investor interest in infrastructure opportunities across Europe.

"Market Milestones: S&P Hits Record High, Macy's Closes Stores, and Disney CEO's Payday"

The Dow Jones Industrial Average and the S&P 500 reached all-time highs, while Macy's announced store closures and job cuts. Disney CEO Bob Iger faced scrutiny over his hefty payday amidst job cuts, and a federal judge blocked the $3 billion merger between JetBlue and Spirit Airlines. Additionally, former President Trump secured Iowa, and the U.S. national debt hit a record $34 trillion. Federal Reserve officials tempered expectations for a rate cut in March, with market forecasts now pointing to a potential cut in May.

Boston Scientific's $3.7 Billion Acquisition of Axonics

Boston Scientific has agreed to acquire Axonics for approximately $3.7 billion, aiming to strengthen its urology business and expand into the high-growth sacral neuromodulation market. Axonics, based in California, develops neuromodulation systems for urinary and bowel dysfunction treatment. The acquisition is expected to be completed in the first half of 2024, with Boston Scientific projecting a highly accretive impact on its urology business in 2024. This move aligns with Boston Scientific's strategy of pursuing M&A to reinforce category leadership and enter faster growth markets.

"Radio Powerhouse Audacy Seeks Chapter 11 Bankruptcy Amid Financial Struggles"

Audacy, a major U.S. radio and podcast company, has filed for Chapter 11 bankruptcy protection to cut down its debt by 80%, reducing it to approximately $350 million from $1.9 billion. The company's CEO, David Field, cited a "perfect storm" of economic challenges and a decline in traditional advertising revenue as the reasons for the financial strain. Audacy, which owns numerous radio stations including prominent ones like WFAN Sports Radio and New York's 1010 WINS, aims to restructure its balance sheet through this process.

"Radio Powerhouse Audacy Seeks Bankruptcy Protection Amid Restructuring"

Audacy, the second-largest radio broadcaster in the U.S., has filed for Chapter 11 bankruptcy to reduce its debt by approximately $1.6 billion, an 80% decrease from its current $1.9 billion debt. The company plans to continue operations normally during the restructuring process and expects to emerge from bankruptcy with a stronger capital structure. Audacy's stock has been delisted from the NYSE and will trade over-the-counter during the reorganization. The bankruptcy plan is set for a court hearing in February, with the aim of obtaining regulatory approval from the FCC.

"Radio Powerhouse Audacy Files for Chapter 11, Strikes Deal to Slash Debt"

Audacy, a major U.S. radio company and owner of iconic stations like KROQ and KCBS, has filed for Chapter 11 bankruptcy protection. The company, which emerged from a merger between Entercom and CBS Radio in 2017, plans to reduce its debt by approximately 80%, from $1.9 billion to $350 million, through a restructuring agreement with its debt holders. Despite the bankruptcy, Audacy expects no operational impact and aims to continue its growth in the audio business, leveraging its multi-platform content and entertainment offerings.

"Haslam Family Lawsuit Against Berkshire Hathaway Over Truck-Stop Valuation Dropped"

The trial to determine if Berkshire Hathaway used an accounting method that undervalued the Haslam family's minority stake in Pilot Travel Centers has been unexpectedly canceled. The reasons for the cancellation are unclear, and it is unknown if a settlement has been reached or how this will affect other claims, including those of illicit payments by Jimmy Haslam. The outcome of the trial could have required Berkshire to pay up to $1.2 billion more for the Haslam's stake. The dispute centers around the use of "pushdown accounting," which the Haslams claim was unauthorized and reduced the value of their stake.

"Rising Coffee Chain Brews Unique Community, Steams Toward Profitability"

Dutch Bros, an Oregon-based drive-thru coffee chain, is rapidly expanding and showing strong financial performance, with 39 new stores in Q3 2023 and a 33% revenue increase year-over-year. The company emphasizes community engagement and customer service, earning high rankings on Forbes' customer service list. Despite competition from giants like Starbucks, Dutch Bros is making significant strides with a 23.9% increase in shop count and a net income jump to $13.4 million for Q3 2023. With a goal of 4,000 shops and nearly $500 million in liquidity for growth, Dutch Bros is positioning itself as a strong contender in the coffee industry.