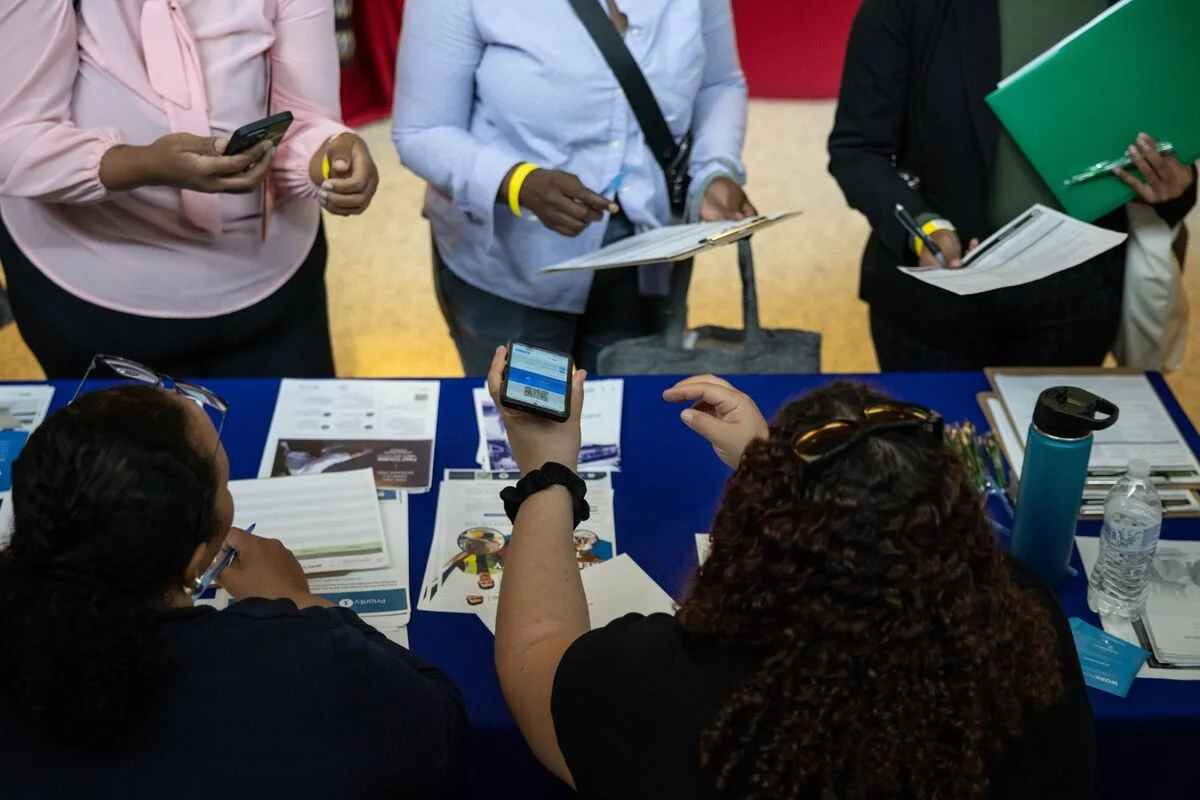

US Job Growth Slows Significantly in 2025, Unemployment Drops

US job creation in 2025 slowed to its weakest pace since 2020, with only 50,000 jobs added in December and an average of 49,000 per month for the year, reflecting a cooling labor market despite steady economic growth and Federal Reserve rate cuts. The unemployment rate decreased slightly to 4.4%, but overall job gains remain subdued amid mixed sector performances and ongoing policy debates.