Partial government shutdown delays January jobs report

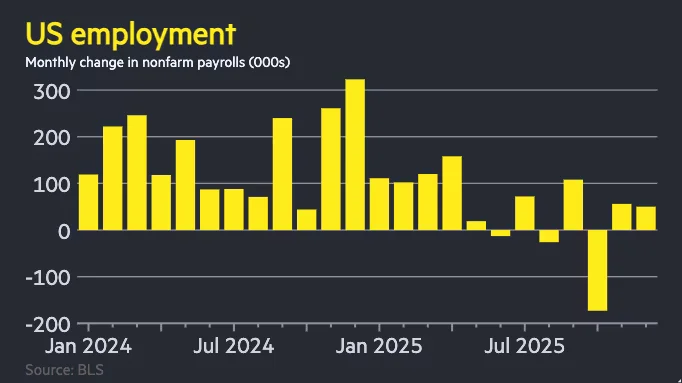

The Bureau of Labor Statistics has postponed the January 2026 Employment Situation release due to the partial government shutdown, with the release rescheduled when funding resumes. The delay comes as a busy data week would have culminated in the nonfarm payrolls report and the Job Openings and Labor Turnover Survey. Markets had expected about 55,000 new jobs and a 4.4% unemployment rate. The shutdown also threatens other data releases, and a resolution by Tuesday is hoped for by Speaker Mike Johnson as Congress negotiates funding for the government and DHS.