"US Banking Sector Faces Soaring Unrealized Losses in Q3, Posing Challenges for FDIC-Insured Banks"

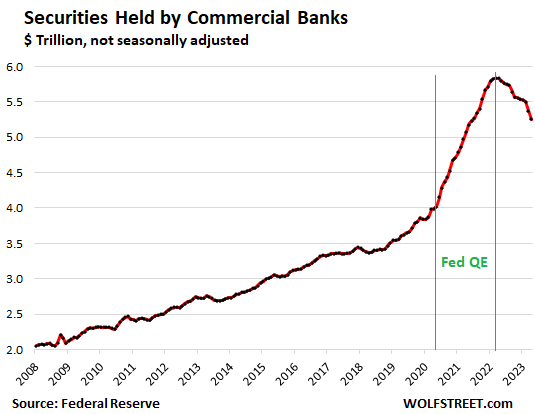

The "unrealized losses" on securities held by FDIC-insured commercial banks increased by 22% to $684 billion in Q3, with the losses spread between held-to-maturity (HTM) and available-for-sale (AFS) securities. These losses occur when interest rates rise and bond prices fall. While these losses don't matter in the short term, they can become significant if banks are forced to sell the securities. Banks are not required to mark these securities to market value, but can carry them at purchase price. The accumulated unrealized losses represent about 13% of the total securities held by banks.