US Banks Continue to Struggle with Deposits and Securities Losses

TL;DR Summary

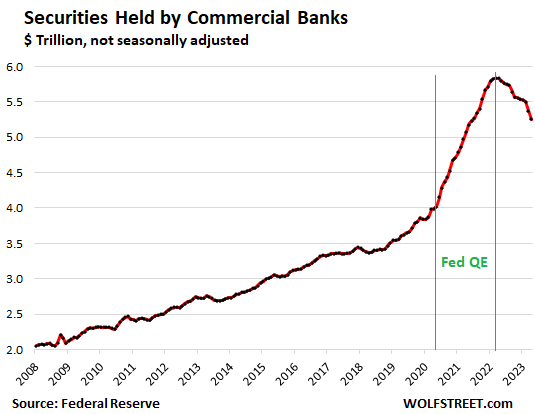

Banks' unrealized losses on securities, mostly Treasury securities and government-guaranteed mortgage-backed securities, held by all FDIC-insured commercial banks in Q1 fell by $102 billion from the prior quarter, to $516 billion. This is a cumulative loss over time on all securities from the purchase, and not an additional loss incurred in the quarter. It was the second quarter in a row of declines: They have now dropped by $174 billion, or by 25%, from the peak in Q3 2022, when unrealized losses had hit $690 billion, according to FDIC data on bank balance sheets released on Wednesday.

- Banks' Unrealized Losses on Securities Drop for Second Quarter in a Row, -25% from Peak WOLF STREET

- Banking crisis caused US bank deposits to fall even as insured deposits rose: FDIC Fox Business

- How credit unions gained some of the deposits banks lost American Banker

- FDIC data reveals deposits dropped in Q1 nationwide and in Pennsylvania - Pittsburgh Business Times The Business Journals

- Why Shares of Truist, KeyCorp, and Comerica Are Falling Today The Motley Fool

Reading Insights

Total Reads

0

Unique Readers

5

Time Saved

4 min

vs 5 min read

Condensed

89%

883 → 97 words

Want the full story? Read the original article

Read on WOLF STREET