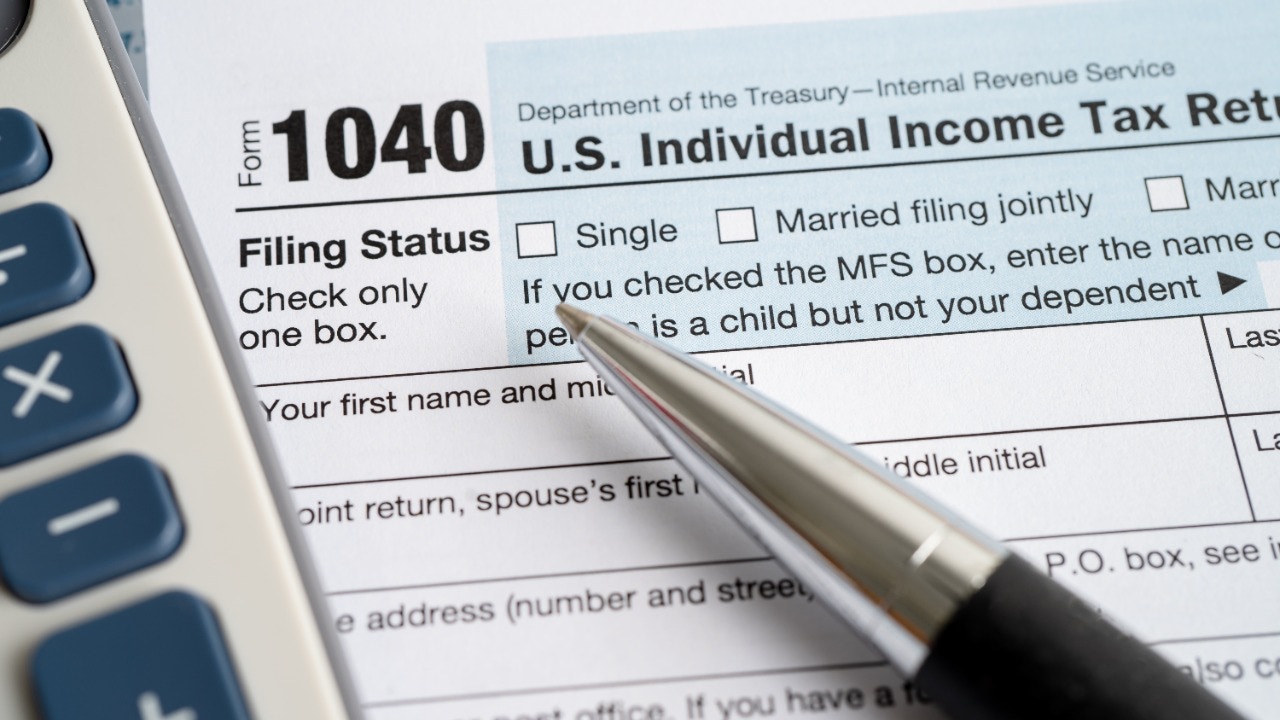

Tax Refunds May Be Seized to Collect Defaulted Student Loans

Millions of borrowers with defaulted federal student loans could have their income tax refunds seized under resumed government collection efforts; taxpayers can call a Treasury Department number to check if they’re on the offset list before filing, with the tax season opening Jan. 26.