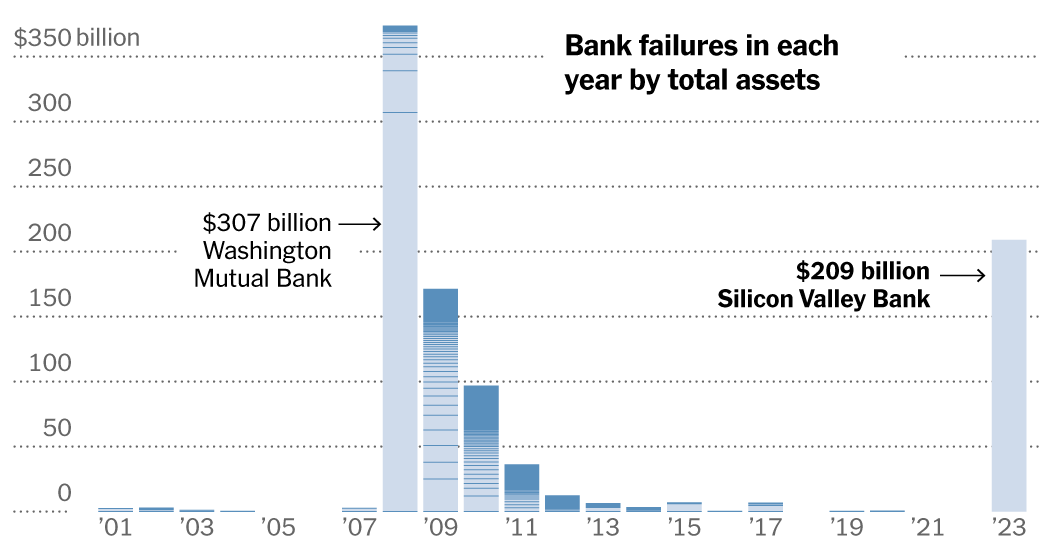

Blackstone Emerges as Top Bidder in Signature Bank Property-Loan Sale

Blackstone is reportedly the leading bidder to acquire a $17 billion portfolio of commercial-property loans from the Federal Deposit Insurance Corp.'s sale of Signature Bank debt. The FDIC has been marketing loans backed by various types of properties, and Blackstone's bid is expected to bring the lowest costs to the agency. The terms of the deal are still being finalized, and Blackstone is in talks to partner with Rialto Capital to service the loans. The sale is closely watched by investors as it provides insights into pricing in the commercial real estate market, which has been affected by rising borrowing costs and declining property values.