Comparing Recent Banking Failures: First Republic, Silicon Valley Bank, and Signature.

TL;DR Summary

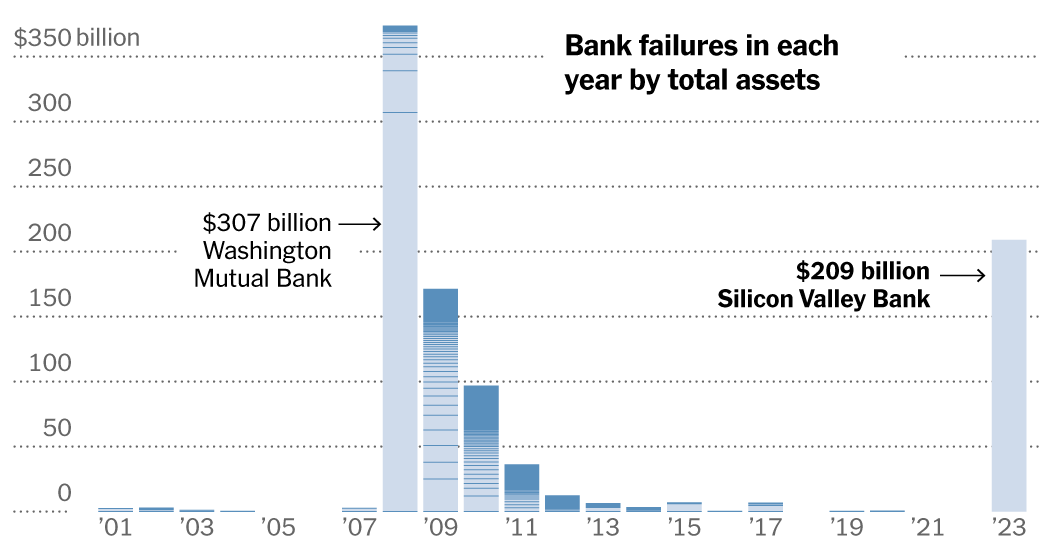

First Republic Bank became the third bank to fail this year after Silicon Valley Bank and Signature Bank collapsed in March. The three banks held a total of $532 billion in assets, more than the $526 billion held by the 25 banks that collapsed in 2008. Stricter regulations have led to fewer bank failures in recent years, but midsize banks like First Republic, Silicon Valley, and Signature do not have the same regulatory oversight. The failure of Silicon Valley Bank was a "textbook case of mismanagement," and the Fed will "re-evaluate" its rules for banks similar in size.

Topics:business#banking-failures#finance#first-republic-bank#regulations#signature-bank#silicon-valley-bank

- First Republic, Silicon Valley Bank and Signature: How Banking Failures Compare The New York Times

- Why First Republic Is Failing The Atlantic

- Small banks are dealing with the ripple effects of two prominent failures last month WUSF Public Media

- Is my money safe? What you need to know about bank failures Yahoo Finance

- Banking's bad day; Collapse of Silicon Valley Bank KTVU FOX 2 San Francisco

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

4 min

vs 5 min read

Condensed

88%

805 → 98 words

Want the full story? Read the original article

Read on The New York Times