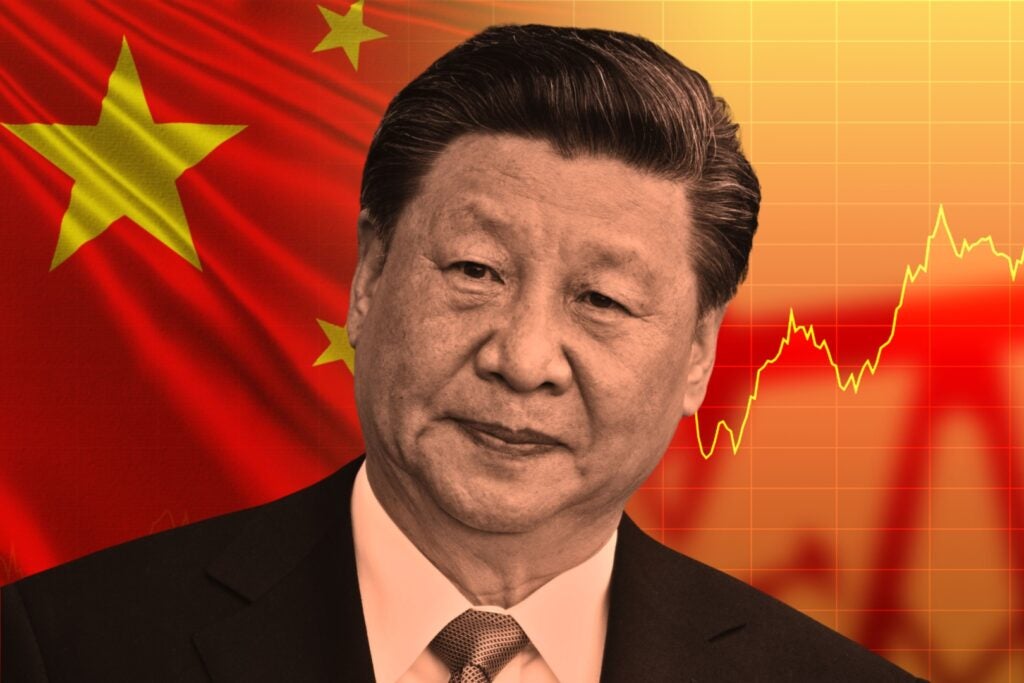

Chinese President Xi Jinping met with U.S. CEOs, providing "tough answers" on the economy, Sino-U.S. relations, Taiwan, Thucydides Trap, and China's governance. Xi extolled the Chinese economy, expressed confidence in addressing challenges, and criticized U.S. efforts to constrain it. He warned against the Thucydides Trap and emphasized China's governance structure. The meeting reflects China's commitment to centralize the economy, with citizens divesting ostentatious items and trying to move money out of the country. Xi desires to mend strained U.S. relations but recognizes the relationship may never return to "old ways."