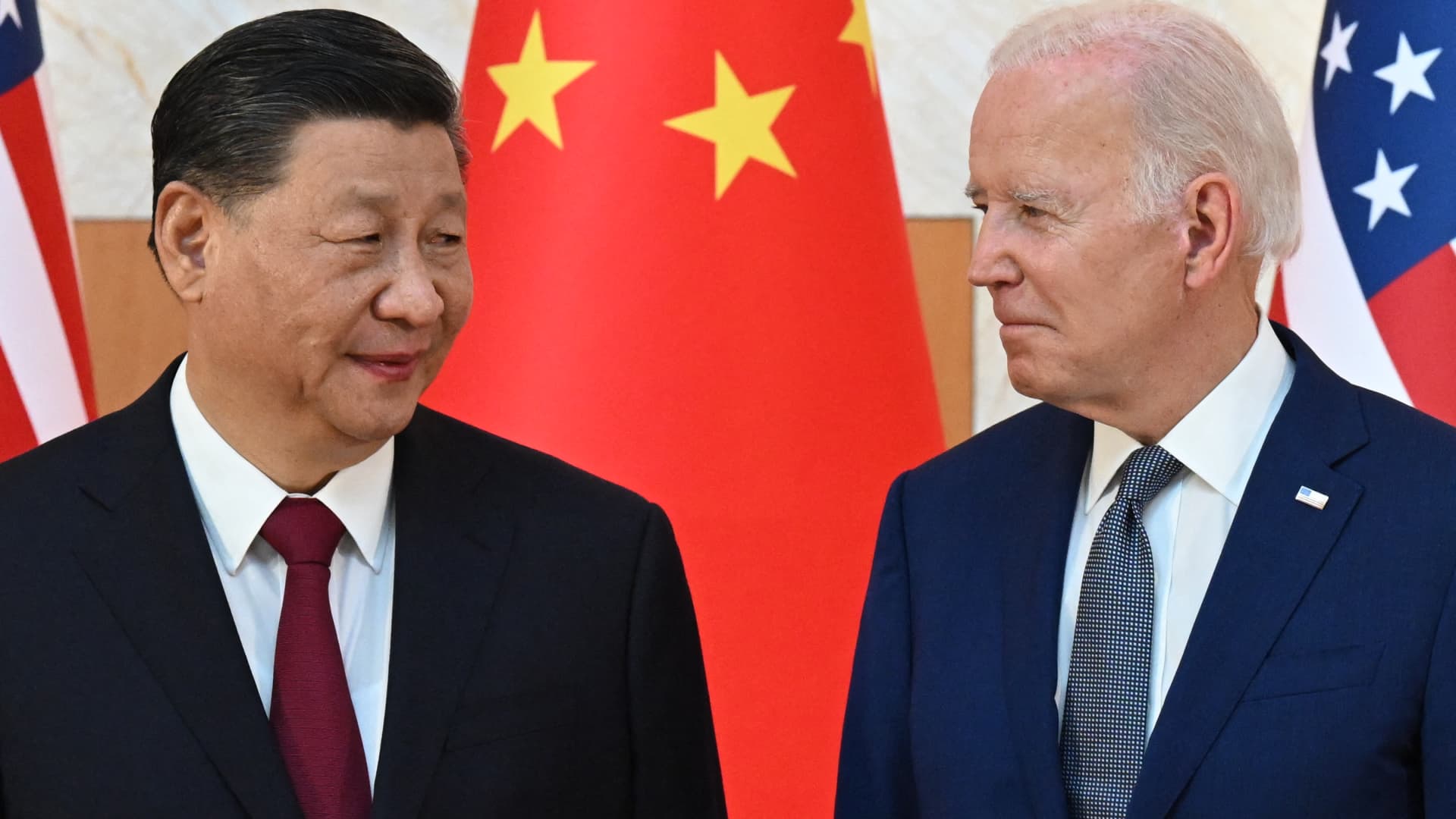

China Clears Nvidia H200 AI Chips for Import, NVDA Rises

Nvidia shares rise in pre-market trading after Beijing approves the first imports of its H200 AI chips, signaling China’s push to balance AI demand with domestic chip development; the initial batch targets major internet firms, with quotas on foreign purchases, underscoring Nvidia’s leadership in AI accelerators.