Starfish Space wins SDA deal to deorbit satellites with on-orbit tug

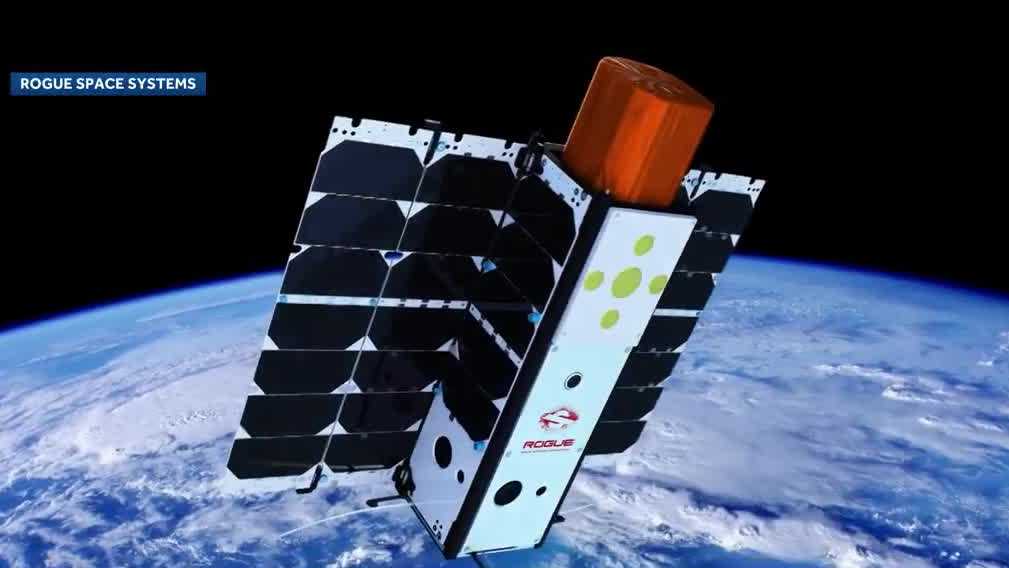

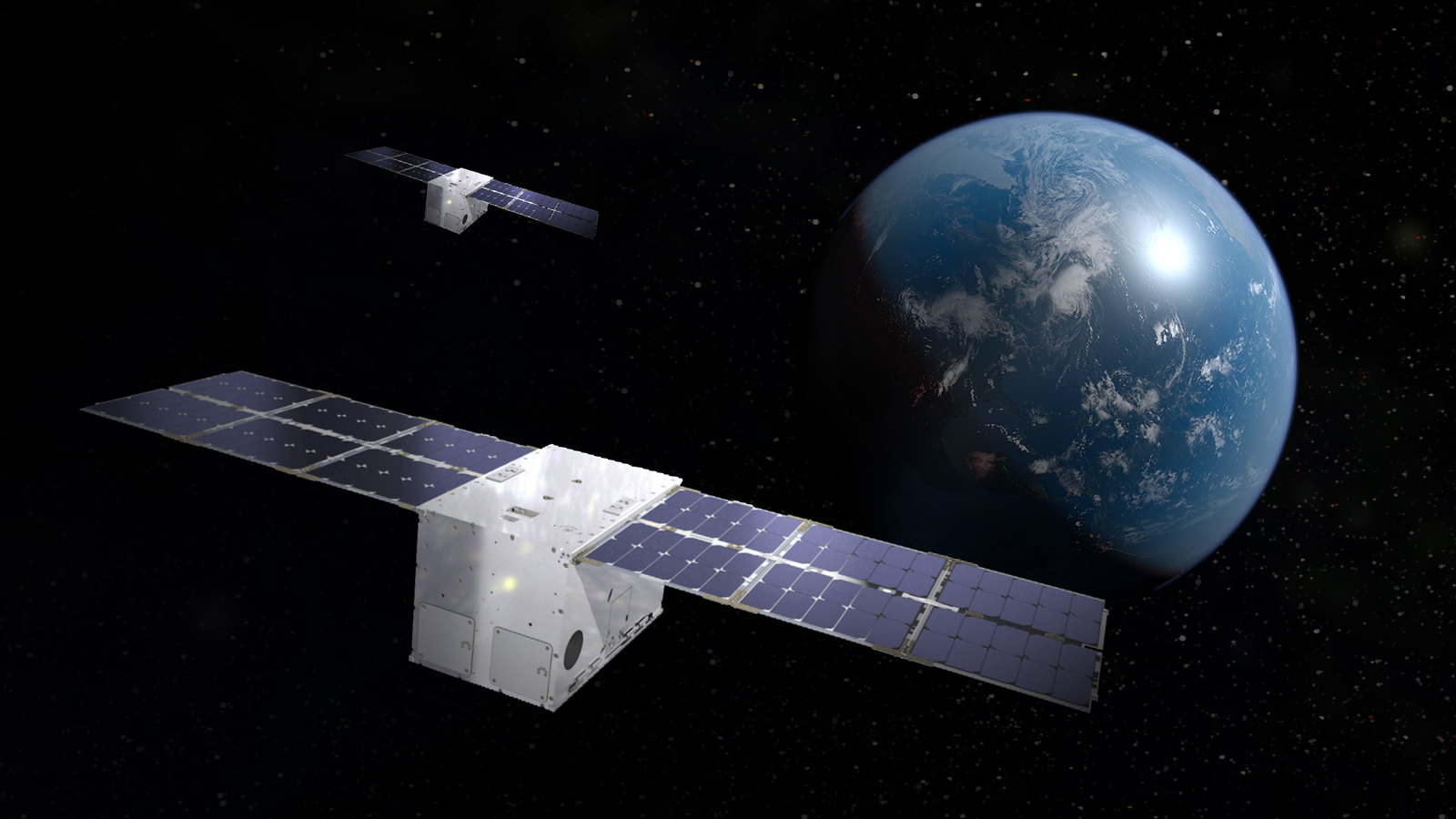

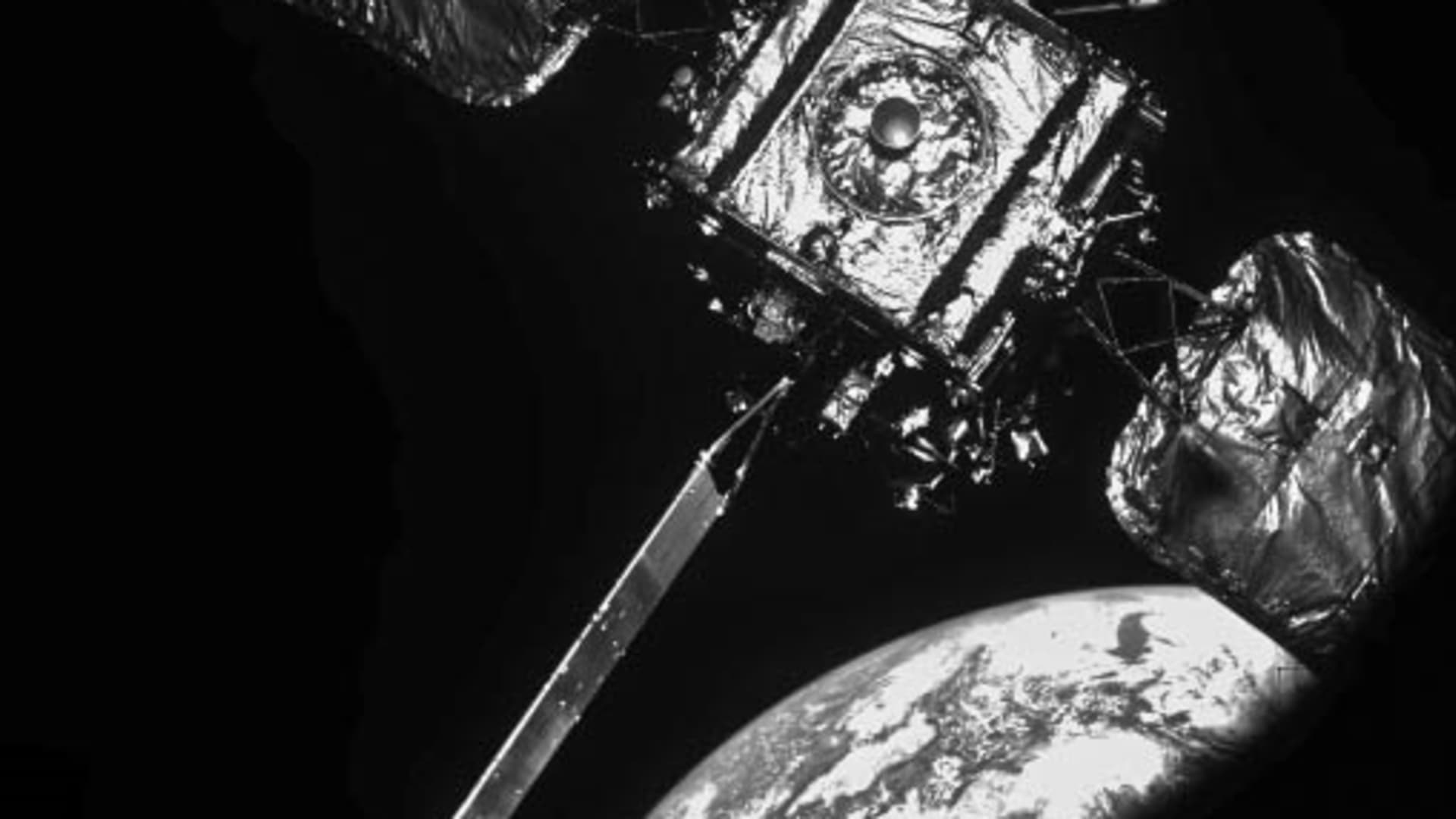

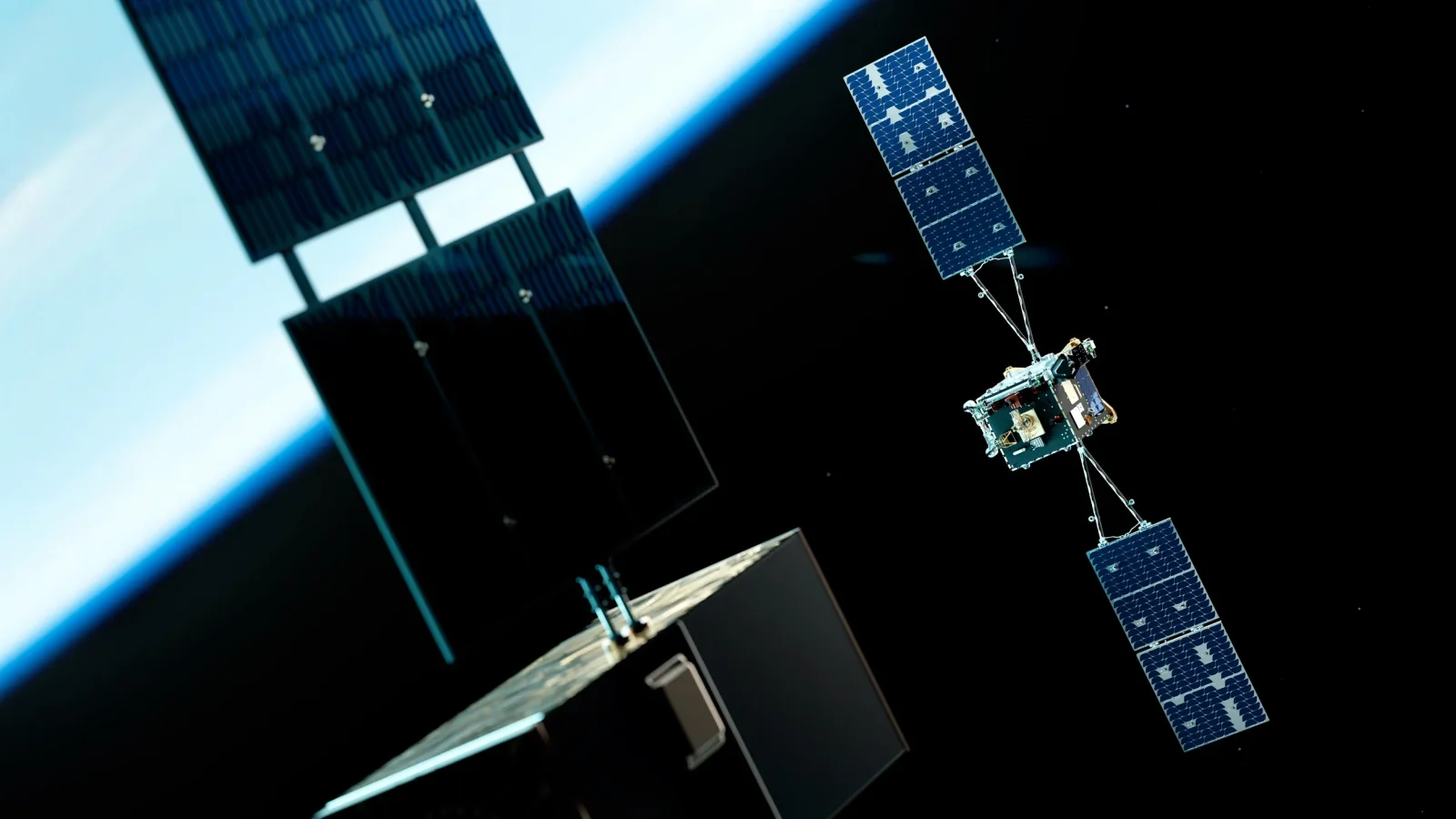

Starfish Space won a $52.5 million contract from the Space Development Agency to provide deorbiting as a service for the Proliferated Warfighter Space Architecture, planning to launch its Otter space tug in 2027 to dock with a non-deorbit-ready PWSA satellite, push it to a lower orbit, and release it for faster reentry, with options to deorbit additional spacecraft; the award signals growing maturity of the satellite-servicing market and complements Starfish’s existing backlog with NASA, the Space Force, and Intelsat/SES.