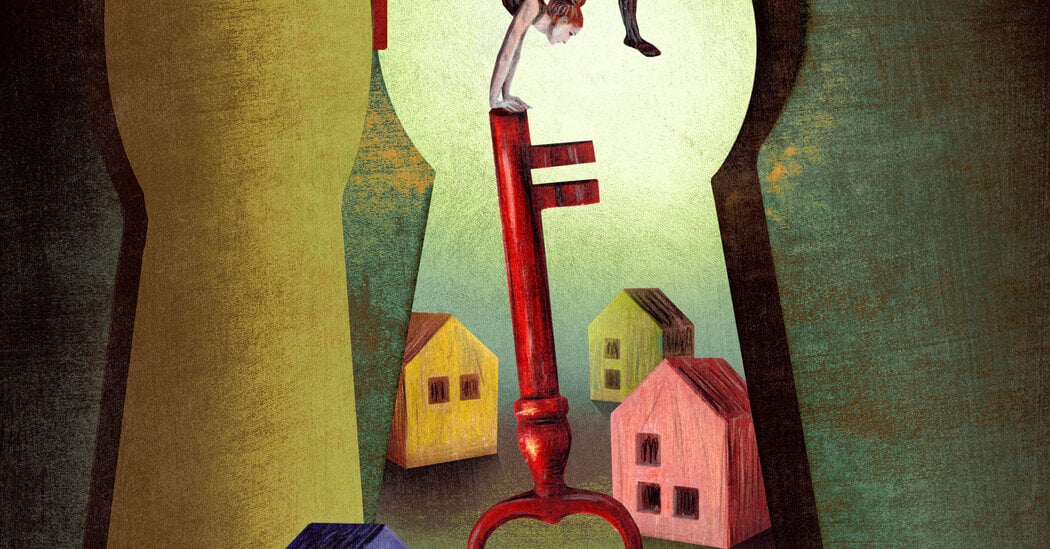

California Homeownership: Changing Trends and Long-Term Residency

In California, the traditional view that homeownership is always financially advantageous is being challenged due to high prices, mortgage costs, and market uncertainties, making renting a potentially smarter financial choice for many, despite the social and personal benefits of owning a home.