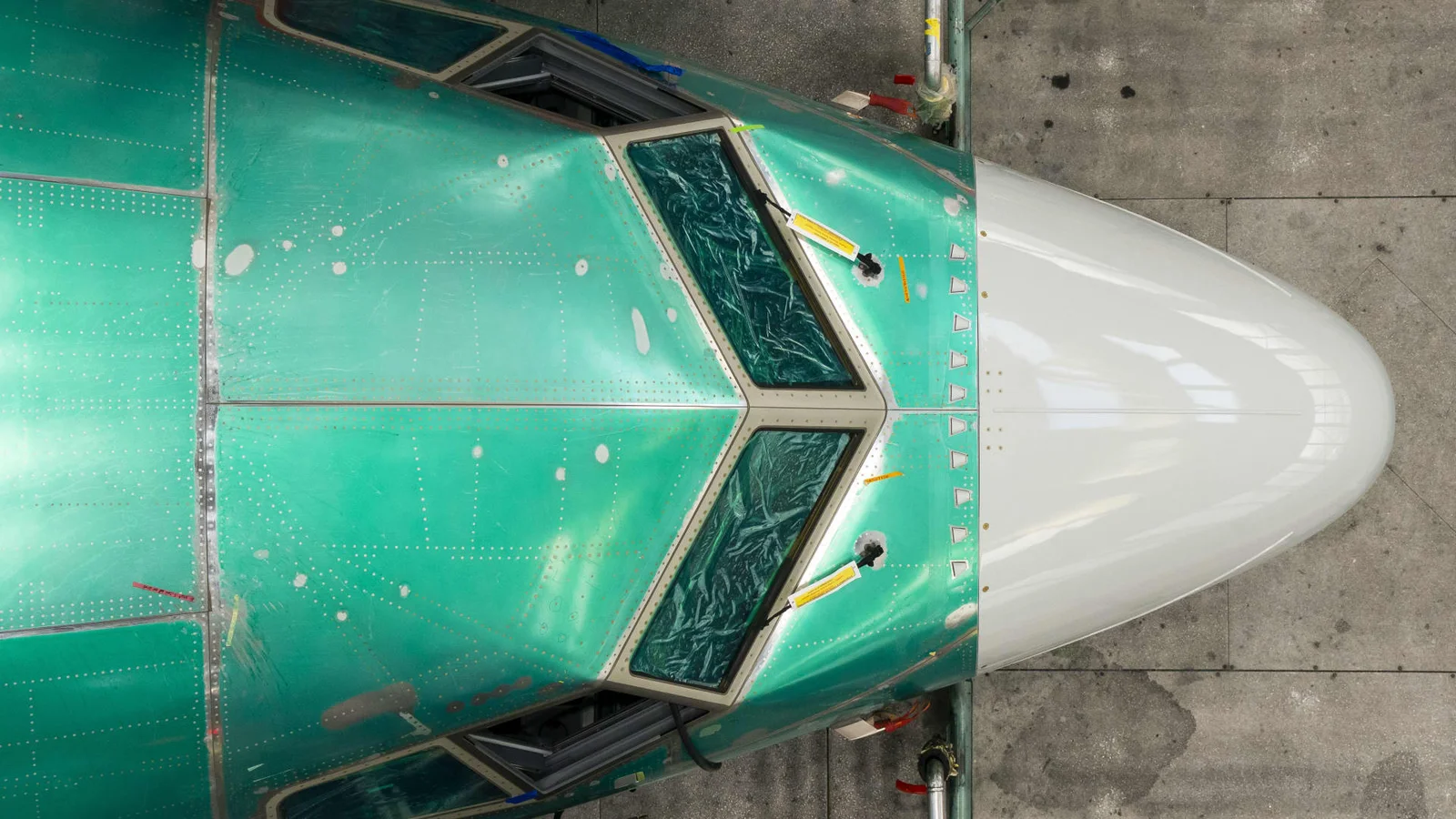

Industrial stock climbs to fresh 52-week high, signaling overbought setup

An industrial stock rose to a fresh 52-week high and now appears overbought, suggesting traders should be cautious for a potential near-term pullback or momentum shift.

All articles tagged with #overbought

An industrial stock rose to a fresh 52-week high and now appears overbought, suggesting traders should be cautious for a potential near-term pullback or momentum shift.

The article discusses the most overbought and oversold stocks in the S&P 500 as 2026 begins, highlighting stocks that experienced significant turnarounds in 2025 and are expected to perform well with low volatility in the upcoming year.

The stock market has reached new highs, but indicators suggest it is overbought and due for a correction, prompting a cautious approach with increased hedges and defensive positions ahead of potential volatility from upcoming Fed decisions.

Ethereum has experienced a strong rally in Q3 with a 46.62% ROI, but signs of exhaustion such as an overheated RSI and over 95% of supply in profit suggest a potential cooldown or pullback before reaching $4,000. The divergence between ETH and Bitcoin, along with high profit saturation and recent whale activity, indicates caution as the market may undergo a shakeout similar to previous cycles.

Bitcoin reached a new all-time high of $123,000, breaking key resistance levels and showing strong momentum, but signs of profit-taking, overbought indicators, and reversing open interest suggest a short-term pause or pullback may occur before the next move.

After a strong May, certain stocks on Wall Street are considered overbought and may experience a pullback, indicating a potential decline following recent market gains.

Bitcoin's recent surge to near $100,000 has raised concerns about potential overheating, with key indicators suggesting caution. The Relative Strength Index (RSI) indicates overbought conditions, while the Spent Output Profit Ratio (SOPR) shows increased profit-taking. Additionally, rising Funding Rates suggest an overleveraged market, reminiscent of past peaks. These factors point to a possible market correction, which could stabilize Bitcoin's growth trajectory.

Nvidia's stock has surged this week, making it one of the most overbought stocks on Wall Street, according to technical indicators. The company's shares have seen a massive rally, leading to concerns about the stock being overvalued.

Chip stocks, particularly Nvidia, are currently in overbought territory and may be poised for a pullback, according to market analysts. The recent surge in chip stocks has pushed them into potentially unsustainable levels, raising concerns about a possible market correction in the near future.

Nvidia's stock has surged to record levels, leading to overbought conditions as indicated by the Relative Strength Index and Bollinger Bands. Despite this, some analysts believe that the breakout marks the beginning of the next uptrend, projecting the stock to rise above $600. The recent rally is attributed to expanded partnerships and adoption by China-based electric-vehicle makers. While overbought indicators suggest abnormal rally levels, they do not necessarily signal the end of the uptrend, with some viewing them as a sign of underlying strength.

Despite concerns about an overbought S&P 500, historical trends suggest that overbought conditions don't always lead to immediate declines. As 2023 concludes with double-digit gains in global markets, the outlook for 2024 appears promising, with inflation moderating and efforts to avoid recession in an election year. Insiders rushing to buy stocks and the potential for additional rallies following substantial surges indicate positive market sentiment. However, prioritizing risk control remains crucial, especially for those who have secured gains, as optimism makes a comeback.

Nearly half of the S&P 500 components currently have a relative strength index (RSI) reading over 70, indicating overbought conditions. While an overbought RSI is typically seen as a warning sign, historical data shows that when at least 45% of S&P 500 components have overbought RSIs, the average 12-month performance afterward has been a gain of 13%. This suggests that despite the frothy market conditions, it could signal the start of a process towards fresh all-time highs for equities.

Market strategists are warning that the recent rally in U.S. stocks, which led to five straight winning weeks for major indexes, may have caused equities to become overbought and could signal a potential payback in early 2024. The rally, driven by expectations of a "soft landing" for the economy after aggressive interest-rate hikes, has also seen a broadening of the market rally across different market capitalizations. However, strategists caution that financial markets have shown a tendency to get overbought and oversold quickly in recent years. Investor sentiment has been optimistic, with bullish sentiment reaching its highest level since August, while bearish sentiment has decreased to its lowest level since January 2018. Despite the increase in bullish sentiment, some analysts believe that investors are not truly bullish but rather see little near-term downside risk. The market may be vulnerable to small disappointments after a strong one-month rally, and a period of consolidation may be necessary.

A strategist warns that the stock market is overbought and due for a correction, despite the broadening of the rally and optimistic views of a soft landing for the economy. The strategist believes that the recent gains are driven by mega-cap stocks, while the broader economy remains weak. Disappointing factory orders, weak industrial production, slower retail sales, and stricter lending standards are cited as indicators of a weaker economic environment. The strategist predicts a potential 10% pullback for the Nasdaq and a 5-6% pullback for the S&P 500, with a 70% chance of breaking last year's October lows in the event of a full-blown recession. This contrarian view contrasts with the increasingly bullish outlooks of other strategists.

Despite reaching overbought levels, the stock market still has room to run as confirmed sell signals have not been registered yet. Major resistance is at 4650, and a pullback to support at 4440 would close gaps on the chart. Market breadth indicators, such as breadth oscillators and cumulative volume breadth, remain bullish. Volatility derivatives and VIX buy signals also support a bullish stance. Recommendations include potential CVB buy signal and a put-call ratio sell signal in Edwards Lifesciences. Trailing stops and rolling procedures are being used for existing positions.