Financestock Market News

The latest financestock market stories, summarized by AI

Featured Financestock Market Stories

"Nvidia's Stock Pause: Analysts Recommend a Breather for Tech Giant"

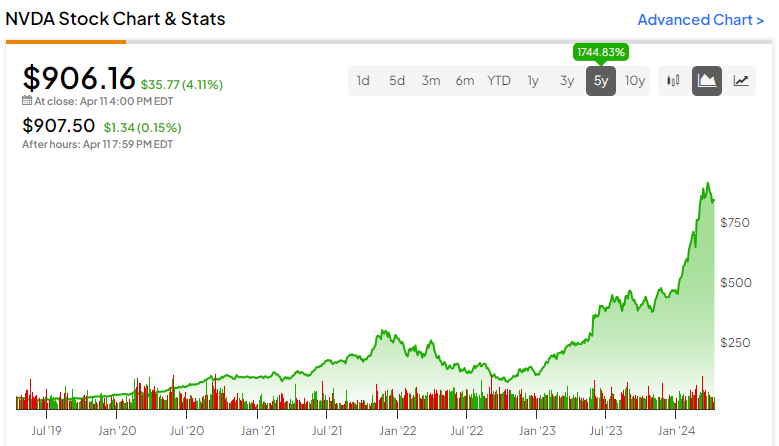

The tech-heavy S&P 500 has been down, with chip-making powerhouse Nvidia experiencing a 15% dip in share price over the past month. F/m Investments President Alex Morris suggests that the recent decline is a natural breather for momentum-driven tech stocks like Nvidia, emphasizing that geopolitical events are not the sole catalyst but provide an opportunity for investors to reevaluate their positions.

More Top Stories

"Analysts Await Netflix's Earnings Report for Insight on Stock Performance"

The Motley Fool•1 year ago

More Financestock Market Stories

"Wall Street Analyst Calls: Nvidia, Apple, Meta, Intel, Cisco, Reddit, Netflix, IBM, MGM & More"

Analysts have made significant calls on several major companies, including Nvidia, Apple, Meta, Intel, and others, providing insights and recommendations for investors to consider.

"Nvidia's Strength Spells Trouble for Arista Stock: Analyst Downgrade and Investor Attention"

Arista Networks' stock was downgraded to sell by a Rosenblatt Securities analyst due to the threat posed by chipmaker Nvidia in the artificial intelligence-driven data center network switches market. The analyst cited Nvidia's strong position in selling AI chips as a competitive edge. Arista's forecasted AI-related sales for 2025 could be impacted by Nvidia's presence in the market. The stock fell more than 7% following the downgrade.

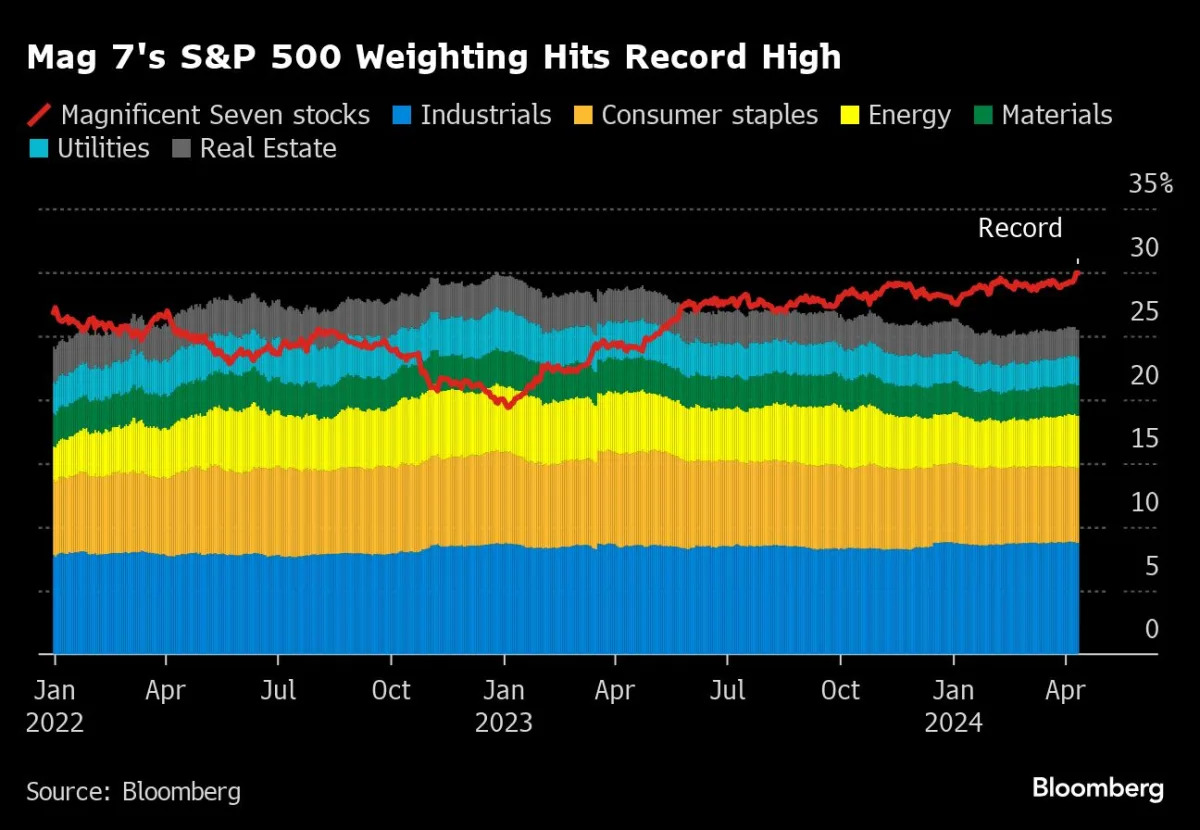

"Earnings Season: The Magnificent Seven's Impact on Stock Market and Global Events"

Despite mixed performances from tech giants like Apple and Tesla, the Magnificent Seven tech stocks, including Alphabet, Microsoft, Nvidia, Amazon, and Meta, now make up almost 30% of the S&P 500, surpassing the combined weight of several other sectors. The group's record weighting comes amid a broad rally in technology shares, with Nvidia's stock surging 81% this year and Meta and Amazon also posting significant gains. However, Tesla's stock slump has weighed down the group, as the company faces challenges with electric vehicle demand.

"Nvidia's Cyclical Nature and AI Dominance: Stock Outlook and Potential for $1,000 Share Price"

Nvidia's stock is trading at high multiples despite potential cyclical risks, with the company's rapid profit growth and high margins possibly nearing a peak. Increased competition and potential economic weakness could impact Nvidia's future earnings, while the semiconductor industry's surge in investment and competition pose additional challenges. Analysts remain bullish on the stock, but some caution that Nvidia's position may resemble Intel's during the dot-com bubble, with potential for a similar downturn in the future.

"Nvidia's Stock Correction: Bank of America Predicts 26% Upside Amid AI Chip Competition"

Bank of America analysts remain bullish on Nvidia despite its recent stock decline, citing the company's strong position in the AI chip space and predicting a 26% upside with a price target of $1,100 per share. They believe that the factors behind the sell-off, such as inflation, competition, and market volatility, do not significantly alter Nvidia's narrative. Nvidia's latest Blackwell chip and strong enterprise foothold contribute to the analysts' confidence in the company's ability to maintain and expand its market share, despite competition from Google and Intel.

"Nvidia Stock Faces Friendly Competition Amidst Market Downturn"

Analyst Gil Luria predicts that Nvidia's stock, which hit a record high in March, could face a downturn by 2026 due to market and technology trends. While he expects a strong performance in the short term, Luria warns that Nvidia's dominance may not last long as its top customers, such as Microsoft, Amazon, and Google, are developing their own custom chips, potentially reducing Nvidia's market share and threatening its revenue margins in the long run.

"Nvidia Shares Plummet as Investors React to Market News"

Nvidia's stock took a hit after an analyst report from D.A. Davidson suggested that the company's dominance in AI-related hardware sales could be coming to an end as big tech companies shift spending to in-house production. The report predicts a significant cyclical downturn for Nvidia by 2026, with a price target of $620 per share, representing a nearly 30% decline from Monday's closing price. However, Nvidia's revenue potential from other segments, such as autonomous driving technologies, could offset this. Despite the stock's recent decline, the analyst has maintained a "hold" rating on the shares, suggesting a potential opportunity for long-term investors.

"From Magnificent 7 to Fab 4: The Stock Market's Evolution"

The once-dominant "Magnificent Seven" tech stocks have now dwindled to the "Magnificent Four," consisting of Nvidia, Microsoft, Meta, and Amazon, as Tesla, Apple, and Alphabet have underperformed compared to their peers. The shift in the market trend has seen some positive upside for certain names while others in the Mag Seven are starting to slow down, with Nvidia leading the pack in market cap growth. Analysts are also bullish on the technical setup for Alphabet, despite its struggles this year.

"From Magnificent Seven to Fab Four: Q1 Market Shake-Up and Wall Street's Search for Sustained Rally"

Nvidia's stock has surged 85% in the first quarter, solidifying its position as a frontrunner among the Magnificent Seven technology companies, while Tesla's stock has struggled, down 20%, due to production setbacks, leadership challenges, tempered outlook, analyst downgrades, reduced delivery forecasts, delayed ramp-up, profit projections slashed, and loss of confidence. Nvidia's success is attributed to generative AI adoption, data center dominance, product innovation, exceptional 2023 performance, and a strong Q4 earnings report, while Tesla faces mounting pressure to overcome operational hurdles and sustain its growth momentum.

"10 Overvalued Stocks and Warren Buffett's Red-Flashing Market Indicator"

As the stock market reaches record highs, concerns about a potential bubble are growing due to high valuations and the AI-hype cycle. Economist David Rosenberg highlighted divergences in the market, suggesting an inevitable downturn, while Warren Buffett's favorite valuation signal is nearing records. The 10 most richly valued stocks include companies like Nvidia, MicroStrategy, and Arm Holdings, with price-to-sales ratios indicating potential overvaluation.