Broad Rotation Replaces Big Tech as Market’s Momentum Trade

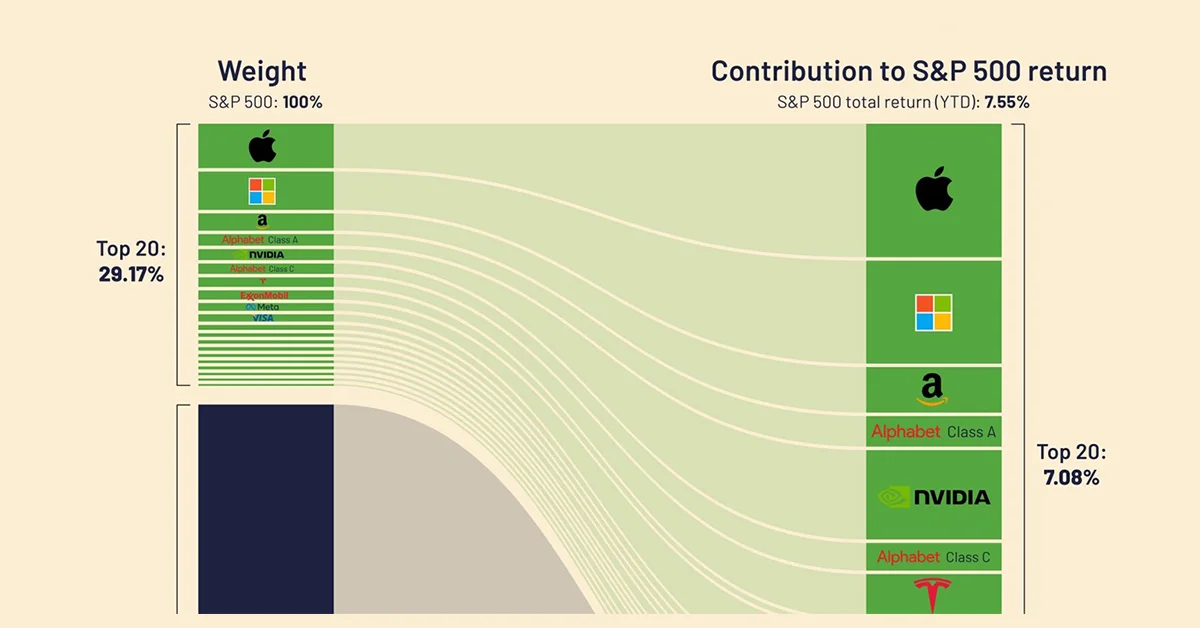

Investors are rotating away from Big Tech into a broader leadership group, expanding market breadth and helping the S&P 500 push higher in 2026 even as concerns about Fed independence linger. The shift has seen consumer staples rally and smaller/mid-cap stocks gain traction, signaling a more durable, breadth-driven rally beyond the magnified Tech-led moves.