Tech Selloff: Super Micro's Plunge Sends Nvidia and AI Stocks Tumbling

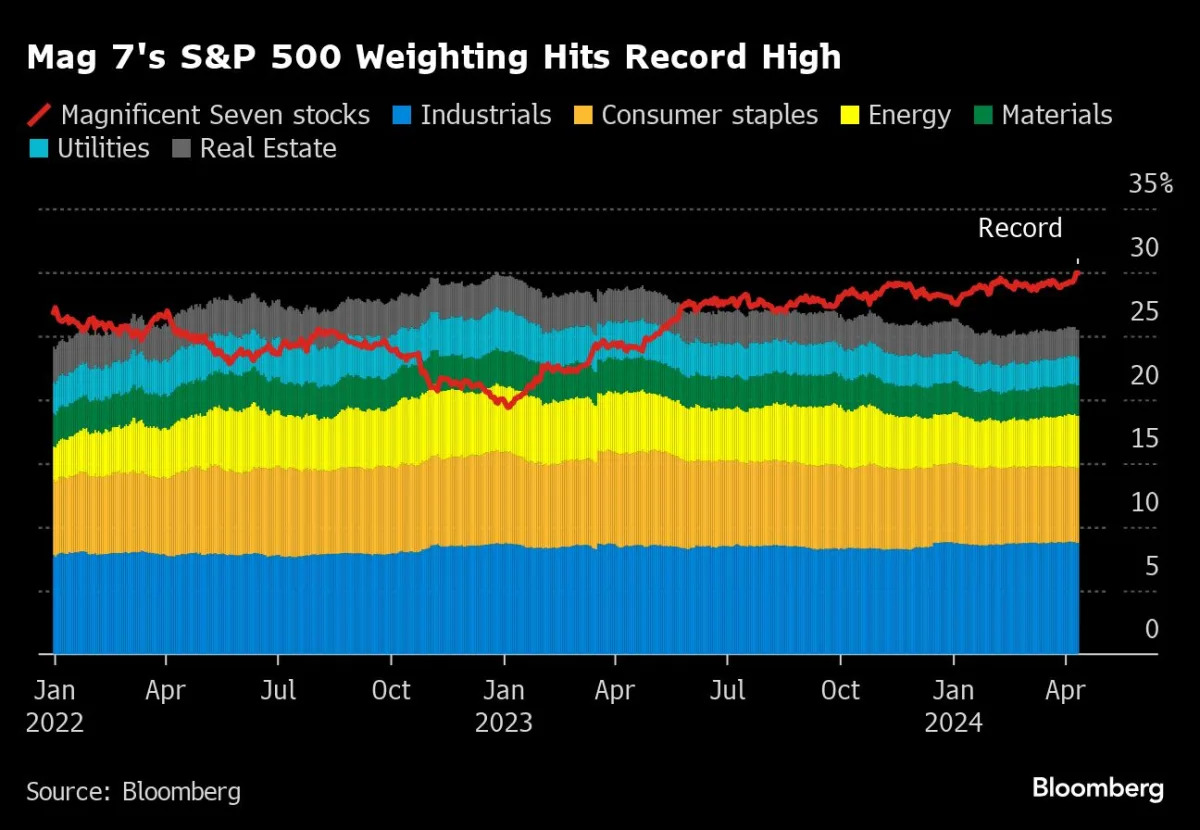

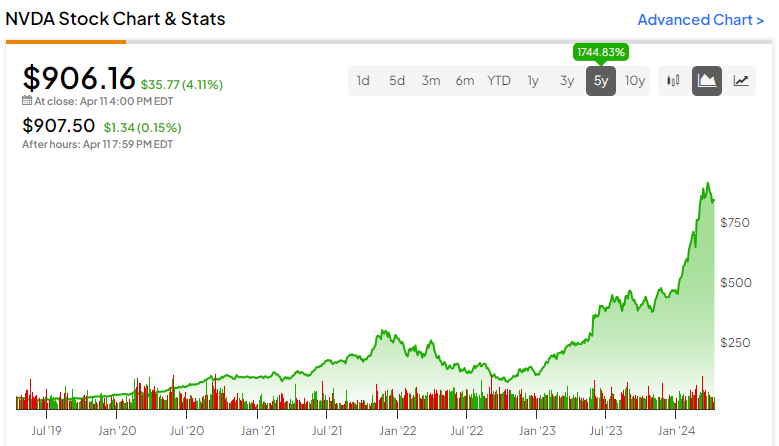

Nvidia and other AI-related stocks experienced a significant drop after Super Micro Computer failed to provide preliminary results and guidance for its upcoming earnings report, causing Nvidia's shares to plummet by 10%. This decline also affected other AI chipmakers and related companies, including Advanced Micro Devices, Arm Holdings, Astera Labs, Broadcom, Marvell Technology, and Micron Technology. The lack of updates from Super Micro Computer led to a loss of confidence in AI stocks, impacting the broader stock market as well.