US Jobs Report Anticipates Slower Hiring and Stable Unemployment in May

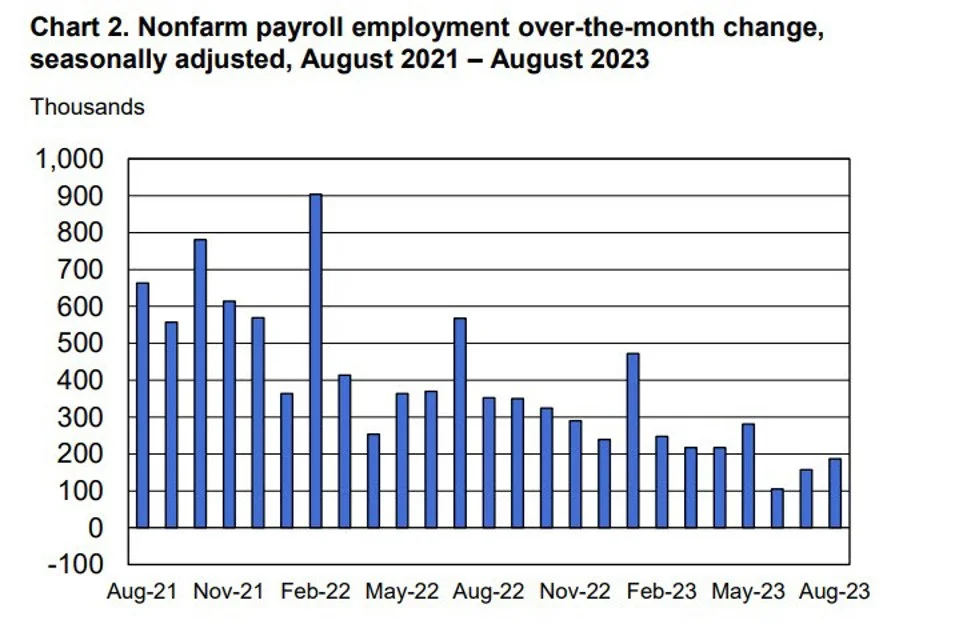

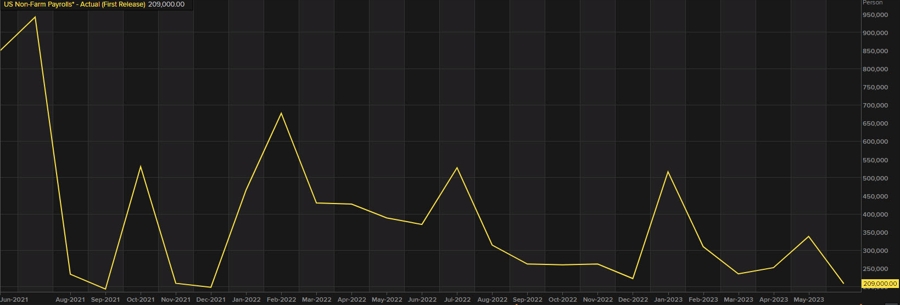

The upcoming non-farm payrolls report is expected to show modest job growth around +130K, with some indicators like ADP and initial jobless claims suggesting mixed signals. The unemployment rate is forecasted to remain near 4.2%, and overall, the report is considered less critical as the Fed adopts a wait-and-see approach later this year.