Economy And Business News

The latest economy and business stories, summarized by AI

Featured Economy And Business Stories

"Top 2023 Moving Destinations Revealed: Texas Leads, Wilmington Shines"

Texas has been named the top destination for movers in 2023, marking the sixth time in eight years it has topped the U-Haul Growth Index. The state's appeal is attributed to its booming industries, absence of state income tax, and housing of the most Fortune 500 company headquarters. California continues to experience a mass exodus, primarily due to its high cost of living. Florida remains the second most popular state for movers, also benefiting from having no state income tax. The top ten states for relocation also include North Carolina, South Carolina, Tennessee, Idaho, Washington, Arizona, Colorado, and Virginia.

More Top Stories

"Billionaires Seek Supreme Court Backing to Protect Trillions in Untaxed Fortune"

Rolling Stone•2 years ago

More Economy And Business Stories

"US Job Growth Surges, Exceeding Forecasts and Boosting Veteran Employment"

The US non-farm payrolls for November exceeded expectations with an increase of 216,000 jobs compared to the anticipated 170,000. Despite a downward revision of the previous month's figures and a decrease in the labor force participation rate, the unemployment rate remained steady at 3.7%, defying expectations of a slight increase. Average hourly earnings also rose more than expected on both a monthly and yearly basis, indicating wage growth. These robust employment figures led to a strengthening of the US dollar and affected market expectations for future Federal Reserve interest rate cuts.

"Alberto Musalem Succeeds James Bullard as St. Louis Fed President"

Alberto Musalem has been appointed as the new president and CEO of the Federal Reserve Bank of St. Louis, succeeding James Bullard. Musalem, a seasoned economist with a background at the New York Fed and in asset management, will start on April 2 and serve the remainder of Bullard's term until February 2026. His appointment continues the recent changes in the Fed's policymaking body, and while he won't be a voting member until 2025, his views on monetary policy will become more evident through his public engagements.

"Mortgage Rate Decline Brings Relief and Competitive Deals for Homeowners"

The average rate on a two-year fixed mortgage in the UK has dropped to its lowest in nearly seven months, now at 5.87%, as lenders like Halifax and HSBC cut rates to retain customers. Despite this, many homeowners with expiring fixed-rate deals still face higher payments. The mortgage price war has intensified, with more lenders expected to reduce rates. Meanwhile, mortgage approvals have slightly increased, indicating a modest rise in buyer confidence. Economists predict the Bank of England may cut interest rates starting in May, which could further impact the housing market and savings returns.

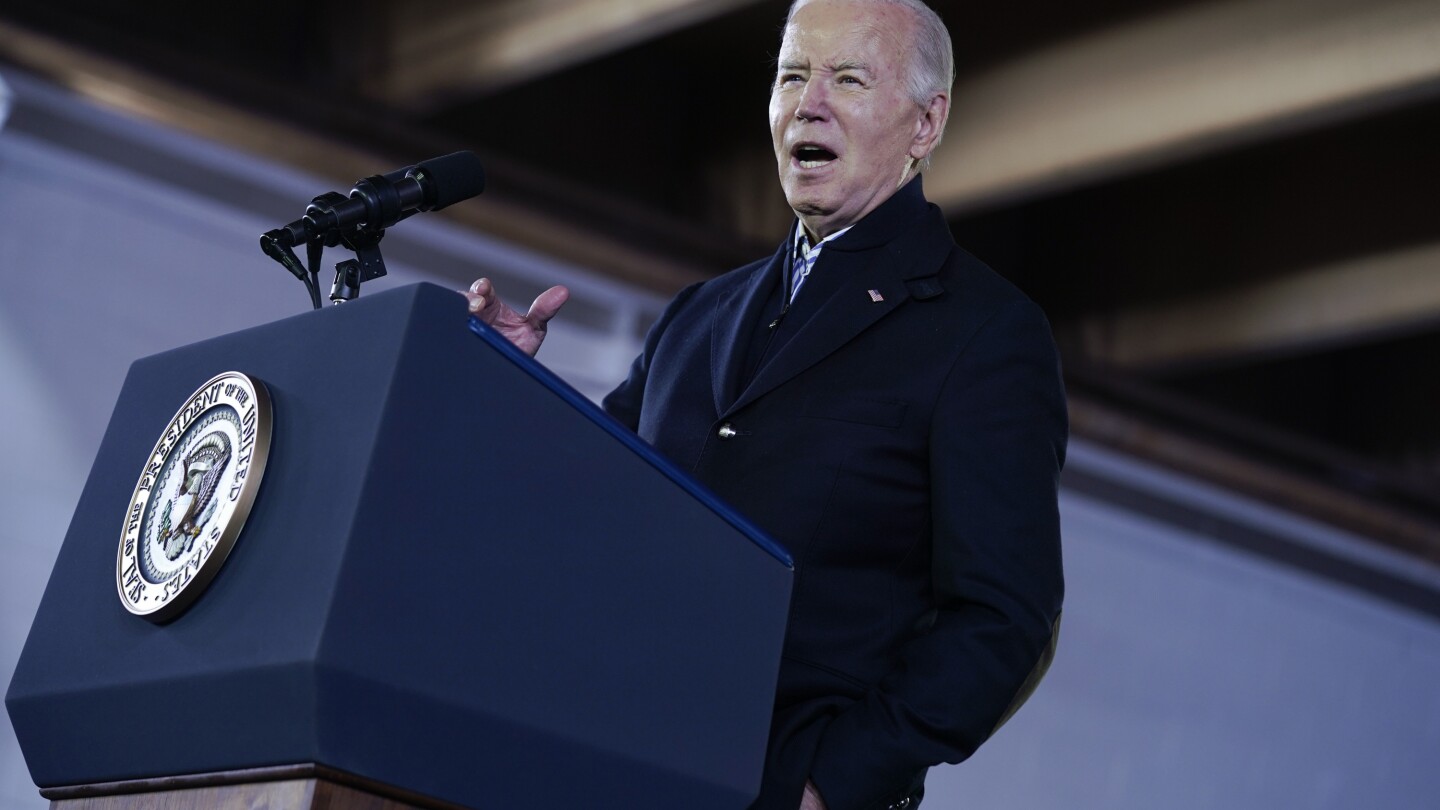

"Biden Administration Invests $162M in Computer Chip Expansion in Colorado, Oregon"

The Biden administration has allocated $162 million to Microchip Technology for expanding computer chip factories in Colorado and Oregon, aiming to triple U.S. production and create 700 jobs. This move, part of the CHIPS and Science Act, seeks to strengthen domestic semiconductor manufacturing, reduce reliance on foreign production, and address inflation by easing supply chain issues.

"Mortgage Applications Dip Despite Interest Rate Decline and Mixed Housing Market Signals"

Despite a decrease in mortgage rates, the Mortgage Bankers Association reported a 9.4% drop in home-purchase applications for the week ending December 29. The average rate on a 30-year loan ended the year at 6.76%, down from an October peak but still high compared to pre-pandemic levels. The housing market remains sluggish due to high rates and a significant 45.1% drop in available home supply since early 2020. Refinance applications also decreased, though they are 15% higher than the previous year. The Federal Reserve's rate hikes have cooled the housing market, but recent declines in mortgage rates offer some optimism for 2024.

"Mortgage Rate Wars Bring Relief as Lenders Slash Deals and Homeowners Save"

UK mortgage rates are showing signs of decline as lenders like HSBC and Halifax reduce their interest rates, with some rates falling below 5% for the first time since April 2023. This trend reflects market anticipation of the Bank of England cutting interest rates by mid-year. Despite a drop in house prices and a sluggish economy, there is a renewed sense of optimism in the market, with an increase in lender confidence and competition. The Bank of England's data indicates a rise in mortgage approvals and consumer borrowing, suggesting potential stimulation in new borrowing. However, the economic outlook remains cautious due to various factors, including the upcoming national election and geopolitical concerns. Capital Economics has moved its forecast for the Bank of England's first rate cut to June 2024, with an expected reduction in the key rate to 3% by 2025.

"Red Sea Unrest Triggers Global Shipping Disruptions and Economic Concerns"

Attacks on ships in the Red Sea by Iran-backed Houthi militants have led to significant diversions in global trade routes, causing ocean freight rates to soar and raising concerns about inflation and delays in the delivery of goods. To avoid the conflict zone, carriers have rerouted more than $200 billion in trade, leading to longer shipping times and higher costs. Freight rates from Asia to Europe and the Mediterranean have more than doubled, and the U.S. and other nations have issued warnings about the consequences of continued threats to shipping. The disruptions may lead to a return of supply chain pressures that contributed to inflation in 2022, and central banks may have to 'look through' the inflation these issues cause. The crisis has also led to increased use of West Coast ports and land-freight services in the U.S., potentially benefiting railroad and trucking companies.

"Federal Reserve Signals Potential Interest Rate Cuts, Leaving Markets in Suspense"

The Federal Reserve's December meeting minutes suggest that interest rates, currently at their highest since 2001, may have peaked and could see reductions starting in 2024. Despite a recent decline in inflation, there is significant uncertainty about the timing of rate cuts. The Fed has held rates steady but indicates that if the economy evolves as expected, rates could drop to 4.6% by the end of 2024, with further decreases anticipated in subsequent years. The decision reflects improvements in inflation outlooks, although inflation remains above the Fed's target.

"U-Haul Trends: Texas Leads While Michigan and Illinois Lag in 2023 Migration Report"

Michigan is ranked as the No. 46 state in the U.S. for growth, based on U-Haul's annual "Growth Index" which tracks migration trends through one-way rental data. Despite a slight increase in arrivals, Michigan's overall position remains near the bottom, though it has improved from its previous No. 48 ranking. The report aligns with U.S. Census data showing Michigan's population decline, particularly in its most populated cities. Contrastingly, states like Texas and Florida lead as top growth states, while California continues to experience the largest net loss.

Fed's Barkin Optimistic on Soft Landing, Cautions on Potential Rate Hikes Ahead

Richmond Federal Reserve President Thomas Barkin indicated that while the U.S. economy is progressing towards a soft landing, with inflation showing signs of easing, the Federal Reserve remains open to further interest rate hikes if necessary. Despite the Fed's recent pause in rate increases, Barkin highlighted ongoing risks, including potential economic slowdowns, geopolitical events, and persistent inflation, that could necessitate additional policy tightening. His comments come as the Fed signals a less aggressive rate cut plan for 2024, contrasting with market expectations of more significant cuts this year.