Trump Demands $230 Million from DOJ for Past Cases

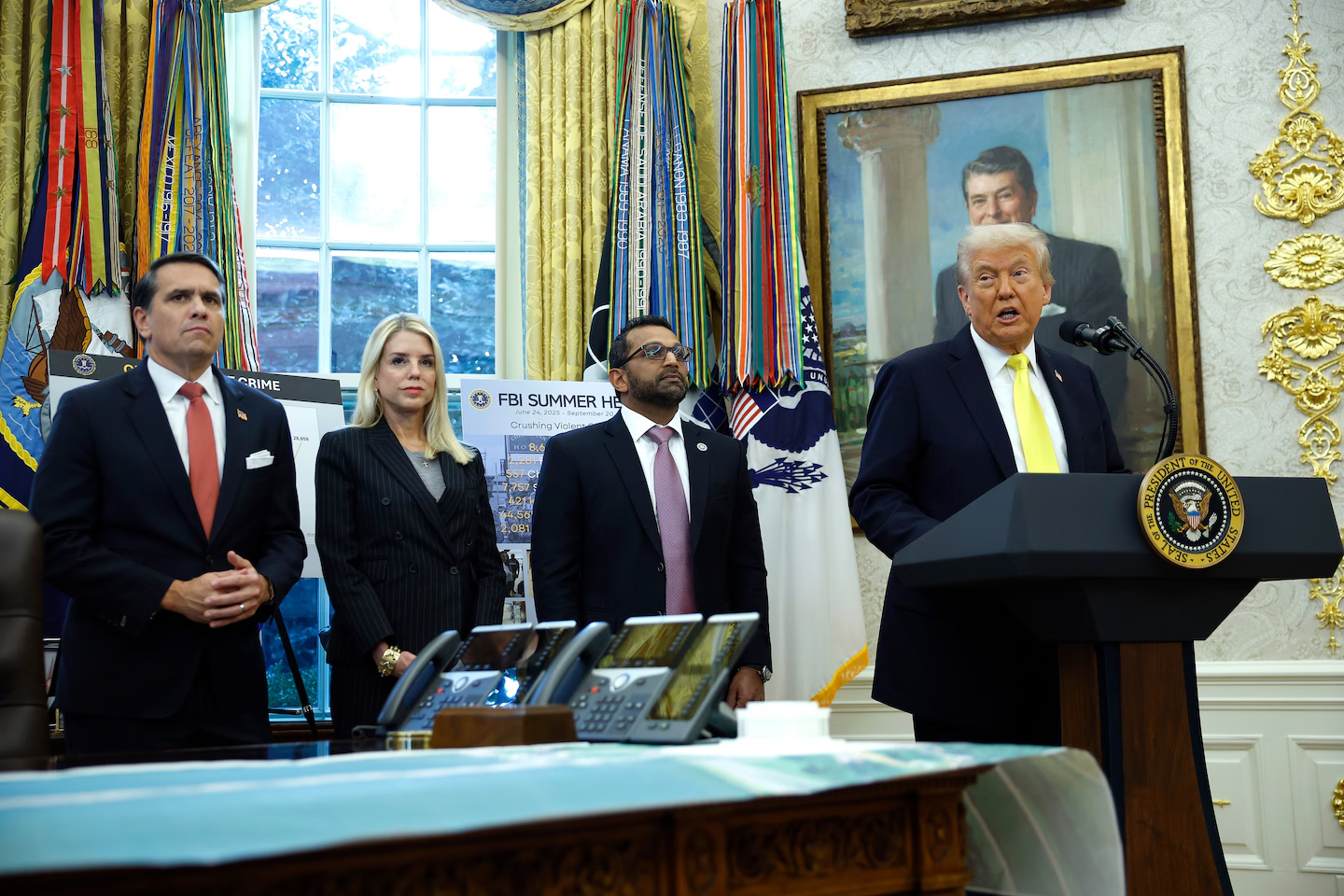

Since his inauguration, Donald Trump has claimed over $100 million from the U.S. government for damages related to investigations into his presidency, and while he has not yet enforced these claims, he could potentially reach a settlement with the Justice Department, raising ethical questions due to the involvement of officials who previously represented him.