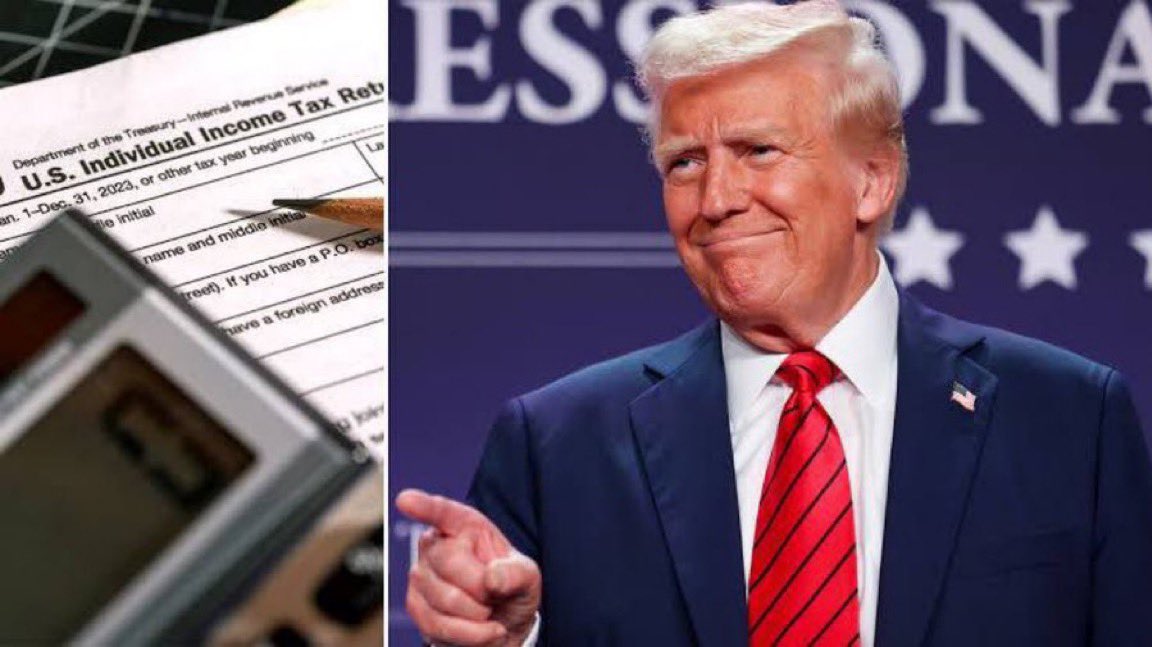

Economist Proposes Tax Cuts to Encourage Seniors to Downsize and Ease Housing Crisis

President Donald Trump is considering legislation to eliminate the capital gains tax on home sales, which could incentivize homeowners to sell and impact the housing market, though details and potential legislative approval are still unclear.