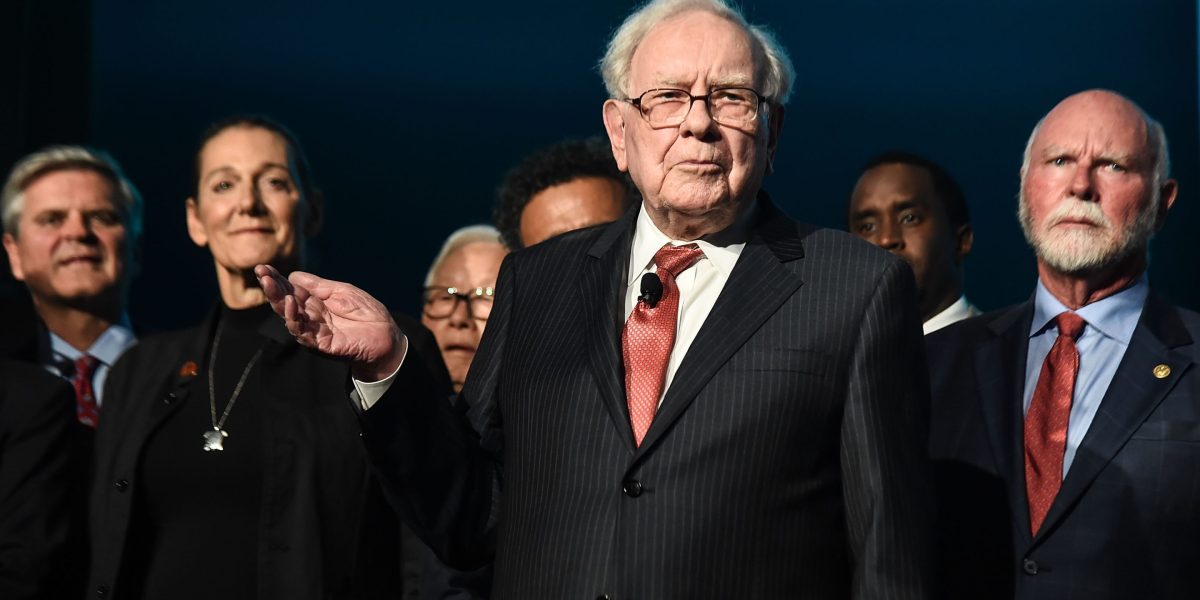

Berkshire Hathaway Sells Apple Stock, Boosts Cash Amid Tax Concerns

TL;DR Summary

Berkshire Hathaway, led by Warren Buffett, has significantly reduced its stake in Apple, selling over two-thirds of its shares in the tech giant, to build its cash reserves to a record $325.2 billion. This move is driven by Buffett's anticipation of a potential increase in capital gains taxes, which he believes may be implemented to address the federal deficit. Despite the sell-off, Apple remains Berkshire's largest investment, and the company has outperformed the S&P 500 over the past three years.

Topics:top-news#apple#berkshire-hathaway#business#capital-gains-tax#investment-strategy#warren-buffett

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

3 min

vs 3 min read

Condensed

87%

601 → 80 words

Want the full story? Read the original article

Read on Fortune