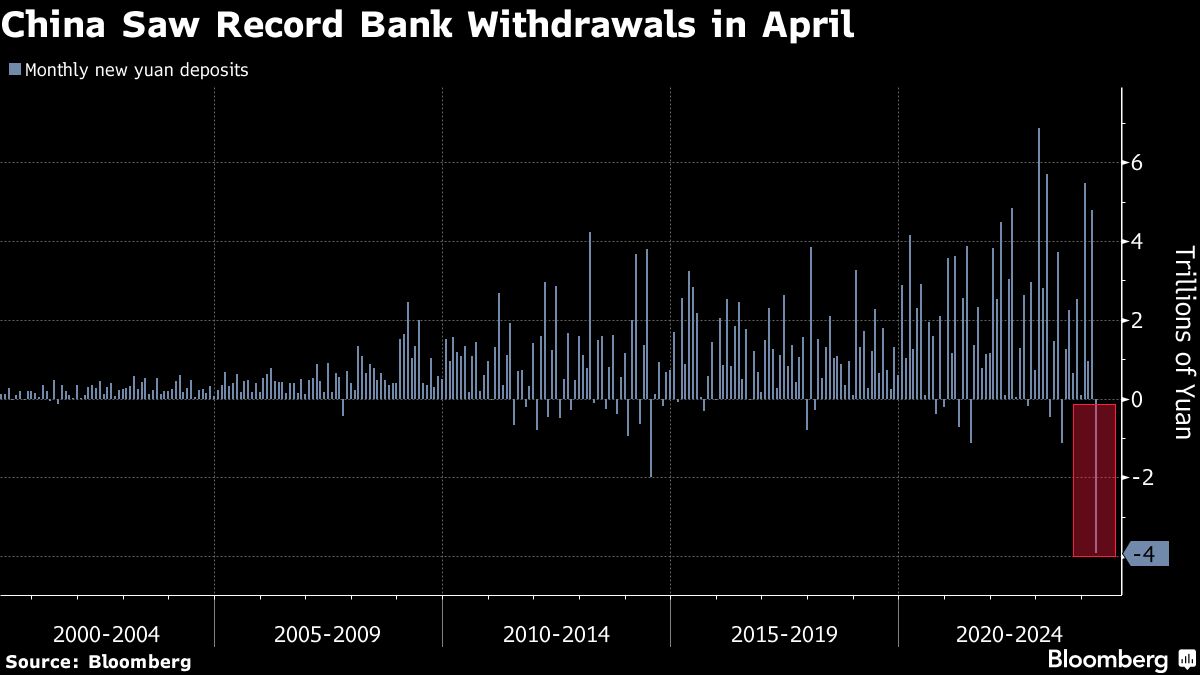

China's $538B Deposit Outflow Fuels Bond Market Surge

TL;DR Summary

China's efforts to stimulate economic growth by reducing the appeal of bank deposits have led to a record $538 billion exodus from cash, with significant funds flowing into bonds and wealth management products. This shift is driven by low deposit rates and policy measures aimed at boosting risk appetite, though it has yet to significantly increase consumer spending or stock investments. The trend reflects low economic confidence, with investors seeking higher returns in safer assets like fixed-income products and dividend stocks.

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

4 min

vs 5 min read

Condensed

90%

839 → 81 words

Want the full story? Read the original article

Read on Yahoo Finance