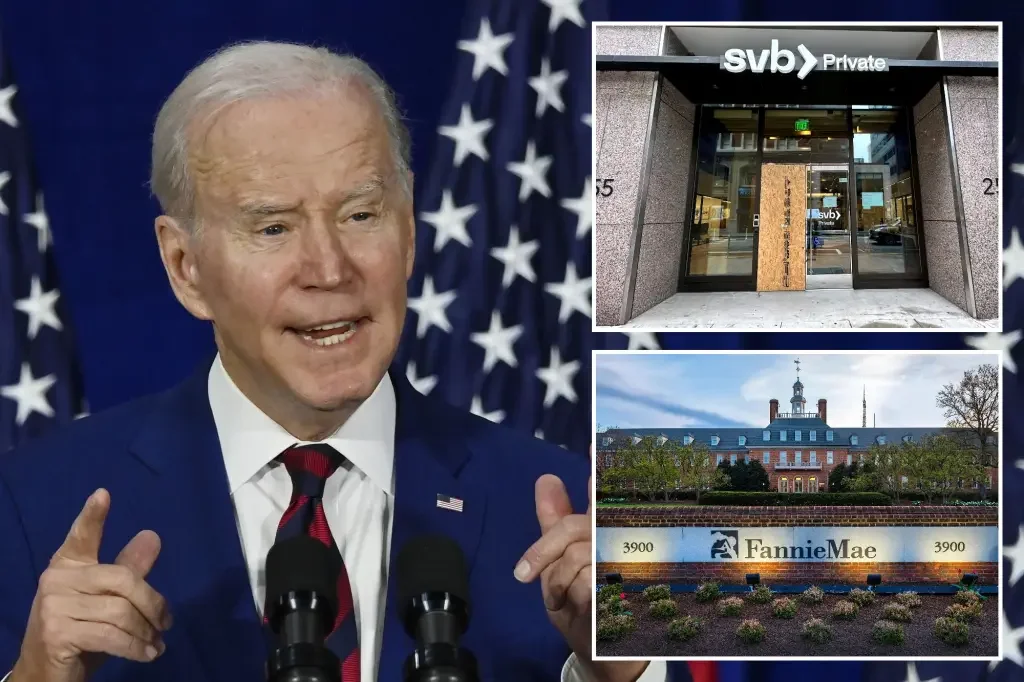

Failed Bank Execs Face Work Requirements and Accusations in Congressional Hearings

During a Senate Banking Committee hearing, Senator John Fetterman suggested work requirements for banking executives that receive taxpayer bailouts. Fetterman also questioned the power of banking executives over the economy and suggested reining in their behavior. At least two prominent Republicans supported Fetterman's idea. However, some conservative commentators criticized Fetterman's speech, citing his lingering auditory processing issues from a stroke he suffered last year. Fetterman's chief of staff said the remark was unscripted, and Fetterman's communications director defended him against the mockery.