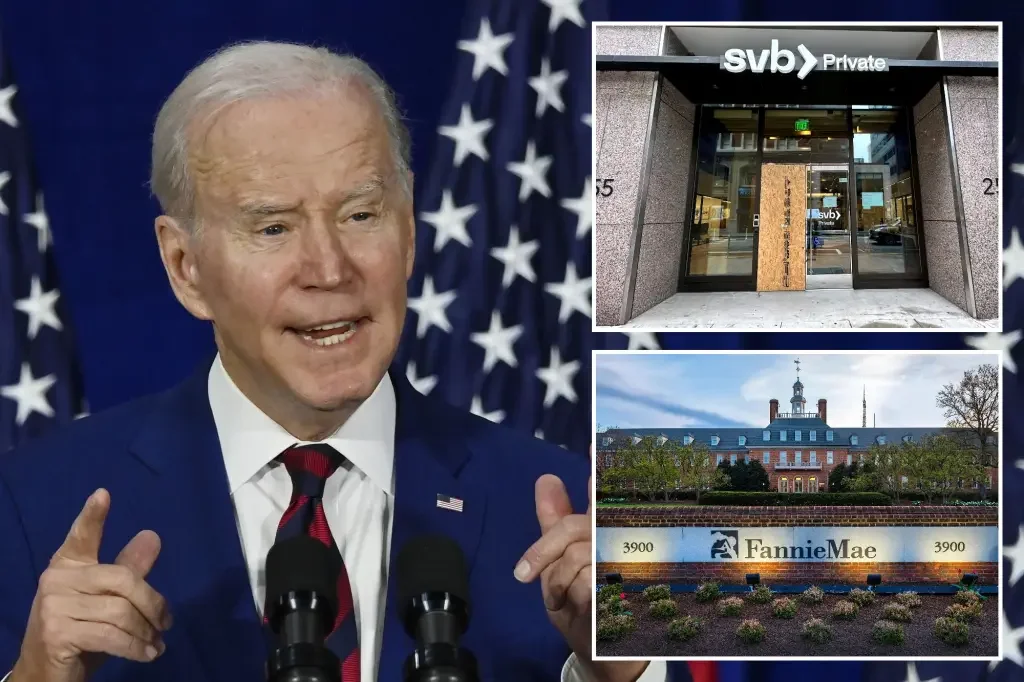

The Controversial Impact of Biden's Bank Policies.

TL;DR Summary

Financial bailouts have been shrouded in deceit and almost always cost taxpayers far more than politicians promised. Despite past debacles, the Biden administration is championing more risky subprime mortgages. Federal intervention to rescue uninsured depositors boosts the costs of the bailout from a manageable loss to up to $175 billion. The only way to reduce systemic risk is to radically reduce Washington’s power over the economy and financial system.

- Biden's bank bailout just the latest in decades of DC disasters New York Post

- Democrats Who Supported Trump’s Bank Deregulation Don't Regret It HuffPost

- Joe Biden Might Have Just Destroyed America's Banks msnNOW

- Opinion | Silicon Valley Bank and Joe Biden's $19 Trillion Monday The Wall Street Journal

- TUCKER CARLSON: The Biden administration sees bank crisis as a means of expanding their control Fox News

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

4 min

vs 5 min read

Condensed

92%

905 → 69 words

Want the full story? Read the original article

Read on New York Post