"Geopolitical Tensions Propel Oil Prices to New Highs"

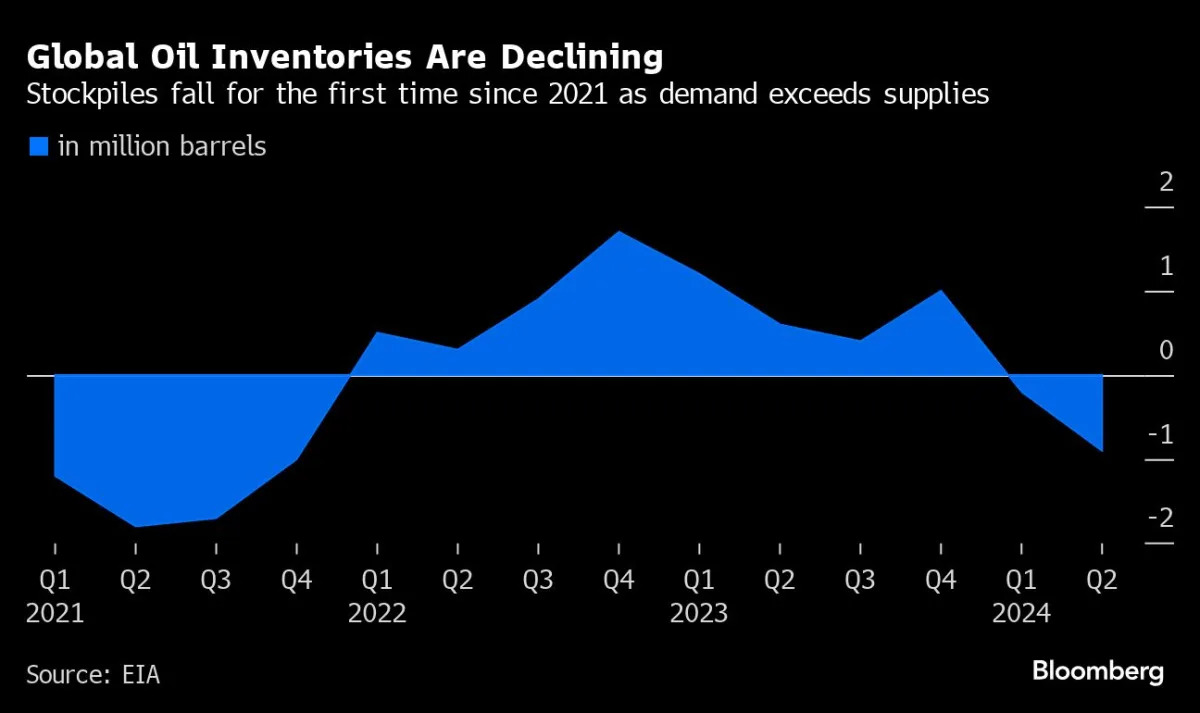

Global supply shocks, including Mexico's crude export cuts, US sanctions on Russian and Venezuelan oil, and Houthi rebel attacks on tankers, are intensifying fears of commodity-driven inflation and pushing oil prices towards $100 a barrel. The disruptions, combined with healthy global demand, are turbocharging an oil rally ahead of the US summer driving season, complicating central banks' rate-cut deliberations and clouding US President Joe Biden’s reelection chances. The surge in oil prices is also snarling the Biden administration’s plans to refill emergency US oil reserves and threatening to push retail gasoline prices higher, contributing to concerns about a reversal in the recent slowdown in consumer price gains.

- The Odds of $100 Oil Are Rising as Supply Shocks Convulse the Market Yahoo Finance

- Latest Oil Prices, Market News and Analysis for April 7 Bloomberg

- U.S. crude oil breaks $86 as tensions mount between Israel and Iran CNBC

- Rising Oil Prices Reignite Inflation Fears The New York Times

- Oil Is Hitting Its Highest Level in Months—Just in Time for Summer Driving Season The Wall Street Journal

Reading Insights

0

2

6 min

vs 7 min read

92%

1,264 → 107 words

Want the full story? Read the original article

Read on Yahoo Finance