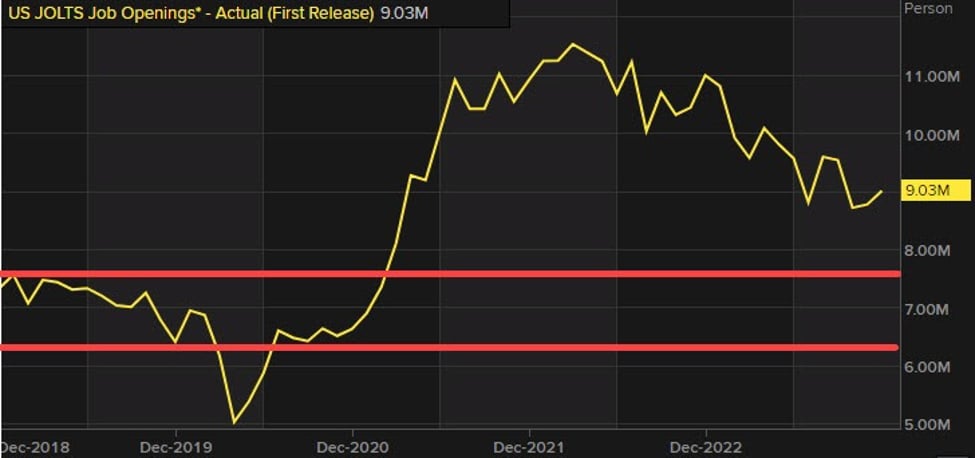

"US Job Openings Surge to 9M in December, Exceeding Expectations"

The latest JOLTS data for December showed job openings at 9.026 million, surpassing the 8.750 million estimate, with the quits rate remaining unchanged at 2.2%. Despite little change in layoffs and discharges, hires were also relatively stable. Total separations, including quits, layoffs, and discharges, remained at 5.4 million. The data, while near post-pandemic lows, exceeded expectations. US yields are trading near highs, with the 2-year yield at 4.346%, 5-year at 4.005%, 10-year at 4.083%, and 30-year at 4.306%.