"Understanding the Bond Market's Reaction to February's CPI Data"

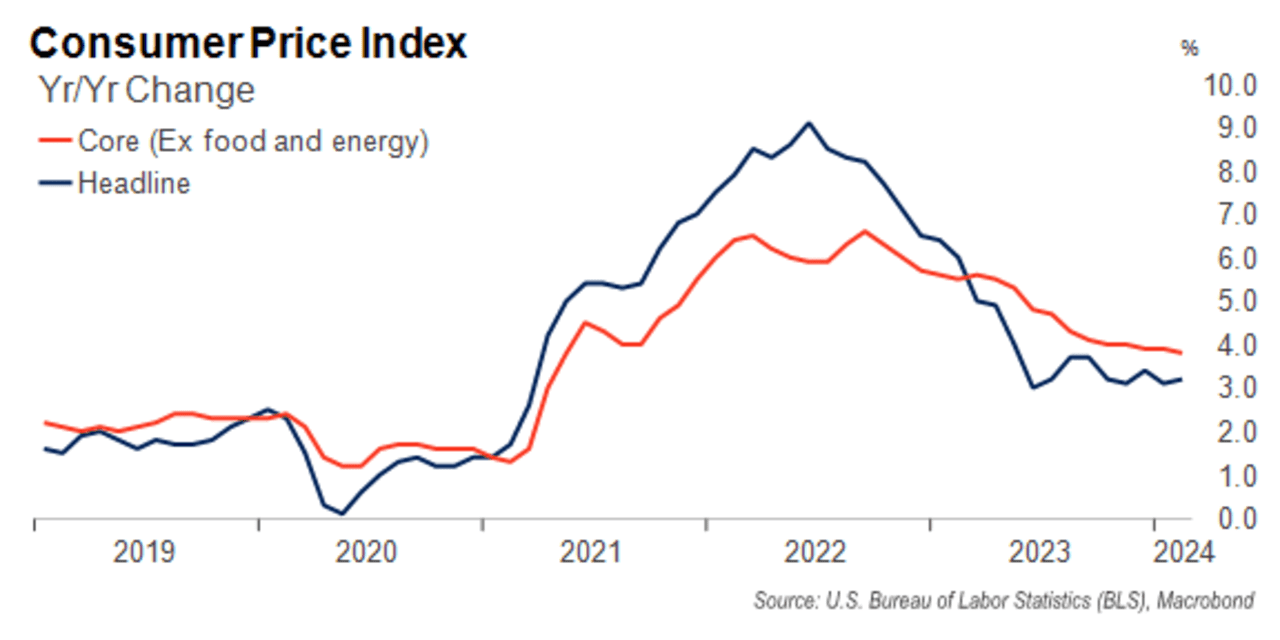

The market's muted reaction to February's Consumer Price Index (CPI) report, which showed higher-than-expected inflation, can be attributed to the fact that it was "clearly braced" for the results, according to analysts. Despite the hotter-than-expected inflation reading, the Dow remained higher, indicating that the market had already priced in the possibility of increased inflation.