"Understanding the Bond Market's Reaction to February's CPI Data"

TL;DR Summary

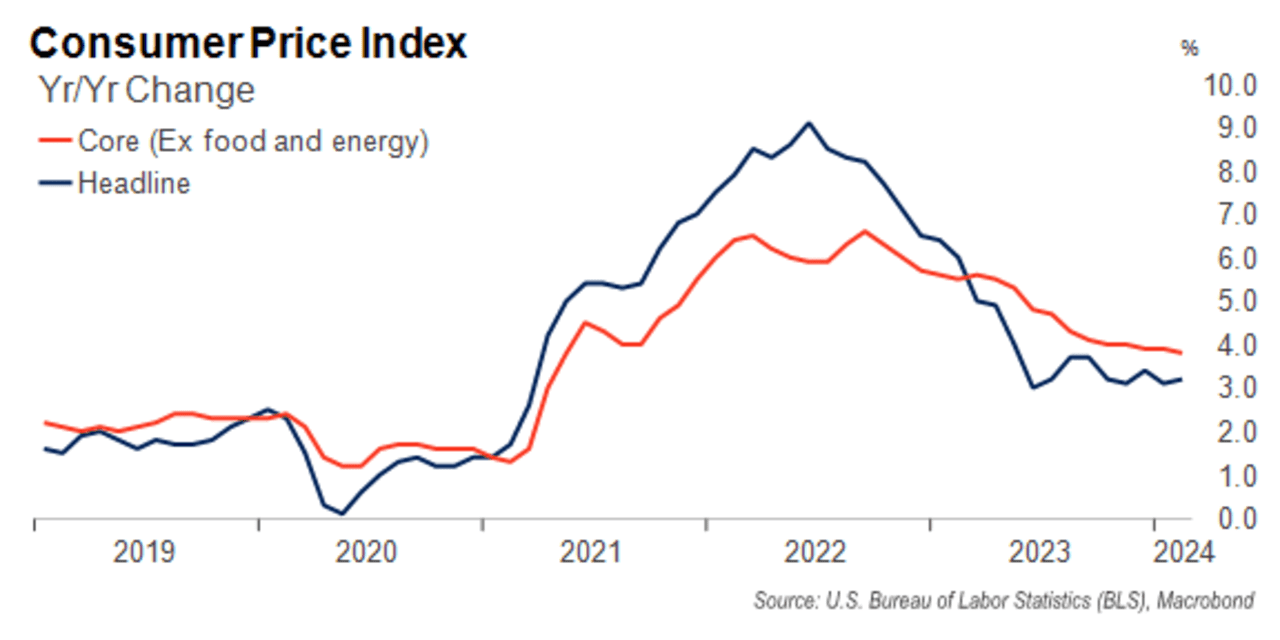

The market's muted reaction to February's Consumer Price Index (CPI) report, which showed higher-than-expected inflation, can be attributed to the fact that it was "clearly braced" for the results, according to analysts. Despite the hotter-than-expected inflation reading, the Dow remained higher, indicating that the market had already priced in the possibility of increased inflation.

- Market was 'clearly braced' for February's CPI, helping to explain muted reaction in Treasurys MarketWatch

- Treasury yields rise slightly as February CPI comes in about as expected CNBC

- Trading US Inflation Is Muddying Bond Market's Auction Gameplan Bloomberg

- Super High Potential Energy Surrounding Tuesday's Data Mortgage News Daily

- Rates Spark: Bonds need better than 0.3% MoM for CPI ING Think

Reading Insights

Total Reads

0

Unique Readers

9

Time Saved

0 min

vs 1 min read

Condensed

-80%

30 → 54 words

Want the full story? Read the original article

Read on MarketWatch