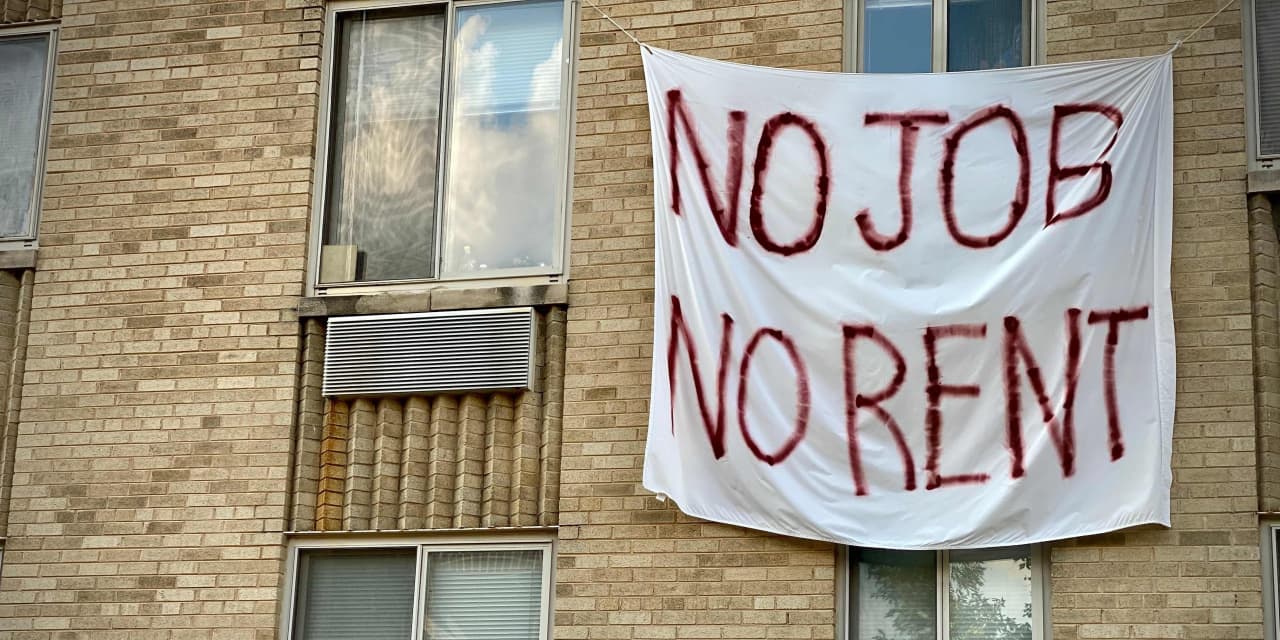

U.S. Labor Market Shows Signs of Softening and Recession Risks

Moody's Analytics warns that the US economy is nearing a recession threshold, with the unemployment rate rising to 4.6% and the Sahm Rule close to triggering a recession signal, amid weak job growth, declining demand, and potential impacts from AI and policy factors.