Decoding the Sahm Rule: Wall Street's Recession Indicator Explained

TL;DR Summary

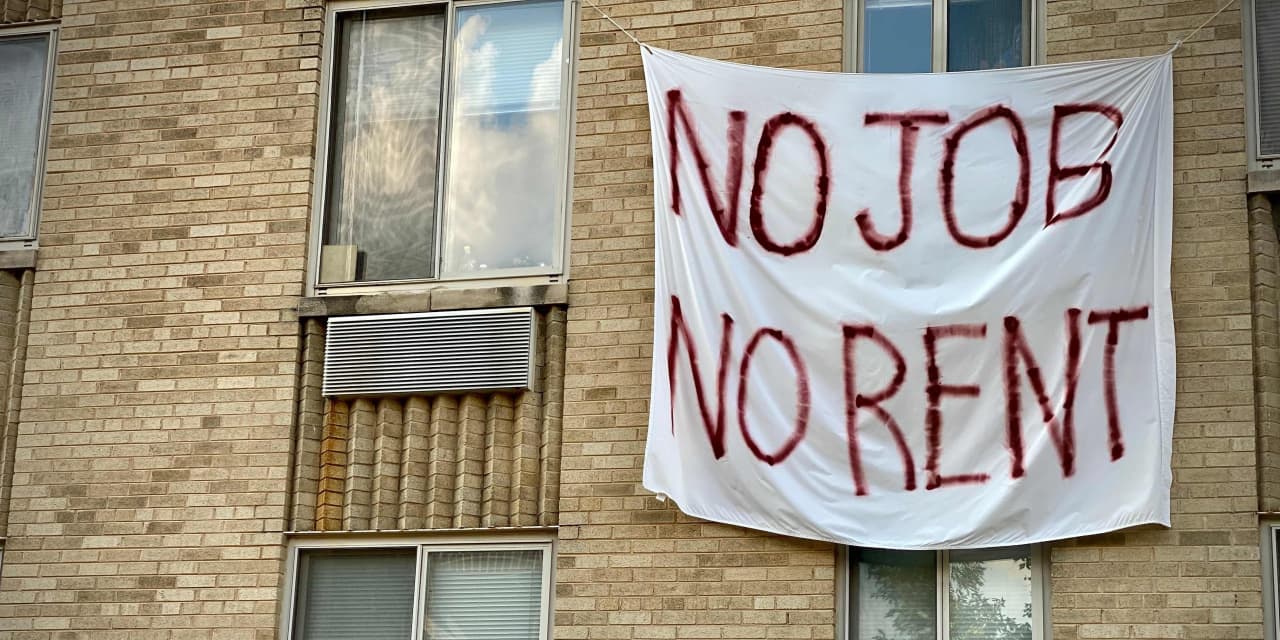

The Sahm rule, an indicator designed to predict recessions, is now further from triggering after the US unemployment rate dropped to 3.7% in November. The rule compares the three-month average of the unemployment rate with the lowest average from the past year, and if the difference is 0.5 percentage point or greater, it triggers a recession warning. While the rule has historically been accurate, its creator, Claudia Sahm, believes it may not trigger this cycle due to workers returning to the workforce and a rebalancing of supply and demand dynamics in the labor market.

Topics:business#economy#federal-reserve#labor-market#recession-indicator#sahm-rule#unemployment-rate

Reading Insights

Total Reads

0

Unique Readers

6

Time Saved

3 min

vs 4 min read

Condensed

87%

711 → 94 words

Want the full story? Read the original article

Read on MarketWatch