Mortgage rate-lock loosens as U.S. housing market shows first signs of a thaw

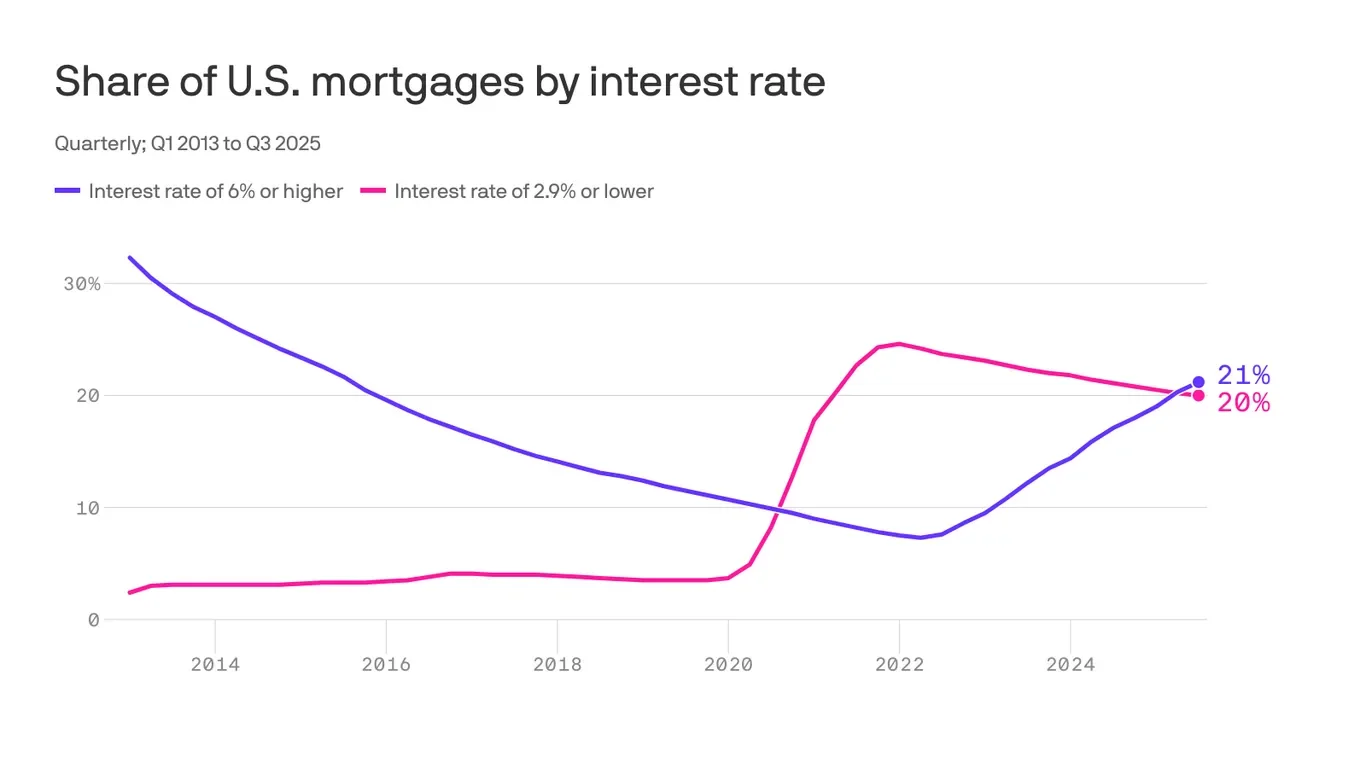

For the first time since 2020, more U.S. homeowners have mortgages at 6%+ than below 3%, signaling a loosening rate-lock in the housing market; about 80% still have rates under 6%, the 30-year average sits around 6.16%, and pockets of activity are emerging as policymakers explore ideas like portable mortgages to spur demand.