Warsh Fed chair bid could ride out a lengthy, restricted confirmation amidst Powell probe

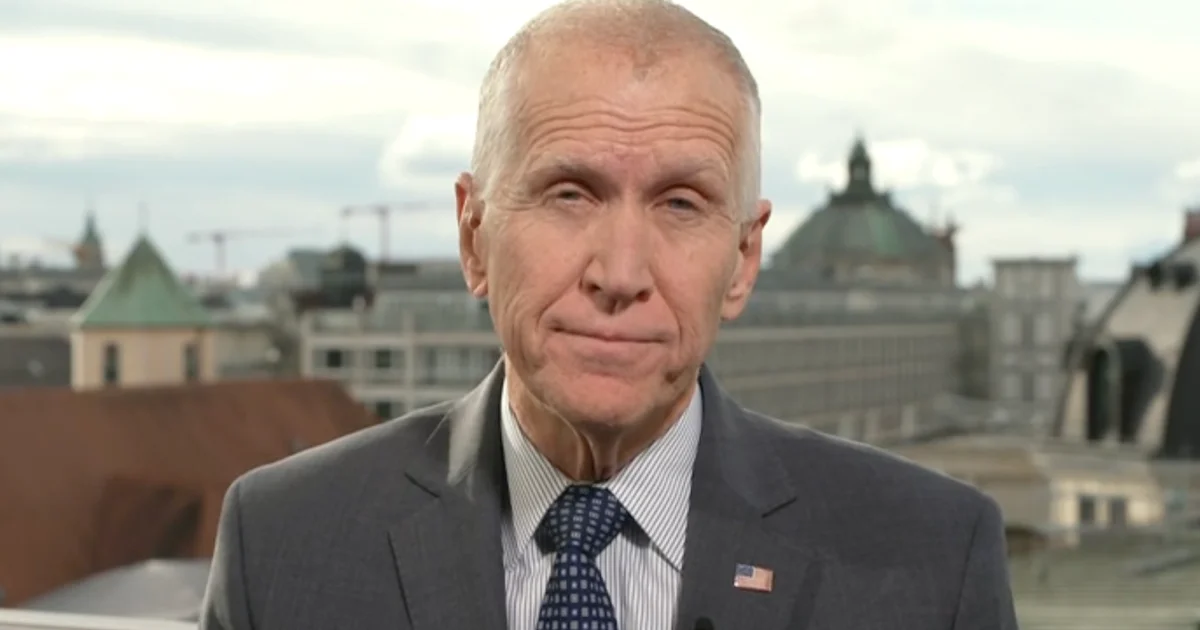

Sen. Thom Tillis says Kevin Warsh’s bid to be Fed chair could face a long confirmation due to restrictions on a nominee’s business life, and he will oppose any Fed confirmation until the DOJ resolves its investigation into Chair Jerome Powell, casting doubt on Warsh’s path as Trump’s pick awaits Senate action.