Warner Bros. Prepares to Reject Paramount's Hostile Bid

Warner Bros is planning to reject Paramount's latest hostile takeover bid, indicating ongoing corporate negotiations and competition in the media industry.

All articles tagged with #media companies

Warner Bros is planning to reject Paramount's latest hostile takeover bid, indicating ongoing corporate negotiations and competition in the media industry.

Warner Bros. Discovery plans to reject Paramount's amended takeover bid, citing concerns over the offer's financial terms and control issues, with a board meeting scheduled next week to decide on the response.

Netflix is exploring a potential bid to acquire Warner Bros. Discovery's studio and streaming assets, having hired a bank to evaluate the opportunity and gaining access to the company's financial data, amid interest from other major tech and media firms.

YouTube has maintained its position as the top TV distributor in the US for six consecutive months, increasing its share to 13.4% in July, surpassing Disney and other media companies, with streaming now accounting for nearly half of all TV viewing.

Warner Bros. Discovery will split into two companies, Warner Bros. and Discovery Global, by mid-2026, with the former focusing on entertainment and the latter on sports and streaming, as part of a restructuring to address debt issues and position for growth.

Warner Bros. Discovery is splitting into two companies by mid-2026: one focusing on streaming and studios, including HBO Max, Warner Bros. Pictures, and DC Studios, and the other on global networks like CNN, TNT, and TBS, aiming for strategic focus and flexibility amid industry changes.

Warner Bros. Discovery is splitting into two separate companies, with one focusing on streaming and studios, including Warner Bros. Television, HBO, and DC Studios, and the other on global networks like CNN, TNT, and Discovery+, to enhance strategic focus and flexibility.

Disney, Comcast, Lionsgate, and Warner Bros. Discovery have significantly reduced their ad spending on Elon Musk's platform X, with a 98% drop from $170 million in 2023 to less than $3.3 million in 2024. This decline follows a pause in advertising due to Musk's controversial actions. Despite some brands resuming ads, overall advertising on X fell 29% year-over-year. Meanwhile, alternative platforms like BlueSky and Threads have gained users post-2024 election.

Spain's High Court has ordered the temporary suspension of messaging app Telegram's services in the country after media companies complained about users uploading their content without permission. The suspension comes after a request by several media firms, and the court has instructed mobile phone providers to block Telegram's services while the claims are investigated. Telegram, which is the fourth most-used messaging service in Spain, has not yet responded to the order.

Disney, Fox, and Warner Bros. are teaming up to launch a joint sports streaming service in response to the challenge of rising sports rights costs and the shift from traditional TV to streaming. The service, set to debut in the fall, will offer games from major professional leagues and college conferences, aiming to attract sports fans who have abandoned cable. It will feature games available on Disney-owned ESPN, and will be distinct from the companies' other streaming services.

Warner Bros. Discovery and Paramount Global have held preliminary talks about a potential merger, with Warner Bros. Discovery CEO David Zaslav meeting with Paramount Global CEO Bob Bakish to discuss a possible combination of the companies. The merger would aim to pool their assets in TV, film, sports, and streaming to gain scale and compete with Netflix and Disney. Warner Bros. Discovery would acquire top-tier film franchises from Paramount Pictures, while the merged entity would also combine their TV operations. The talks are in the early stages, and the terms of the potential merger are unknown.

Attorney General Ken Paxton of Texas has filed a lawsuit against the U.S. Department of State, Secretary of State Antony Blinken, and other government officials, accusing them of conspiring to censor and deplatform American media outlets disfavored by the federal government. The lawsuit alleges that the State Department, through its Global Engagement Center, actively intervened in the news-media market to limit the reach and viability of domestic news organizations by funding censorship technology and private censorship enterprises. The complaint describes this as one of the most egregious government operations to censor the American press in history.

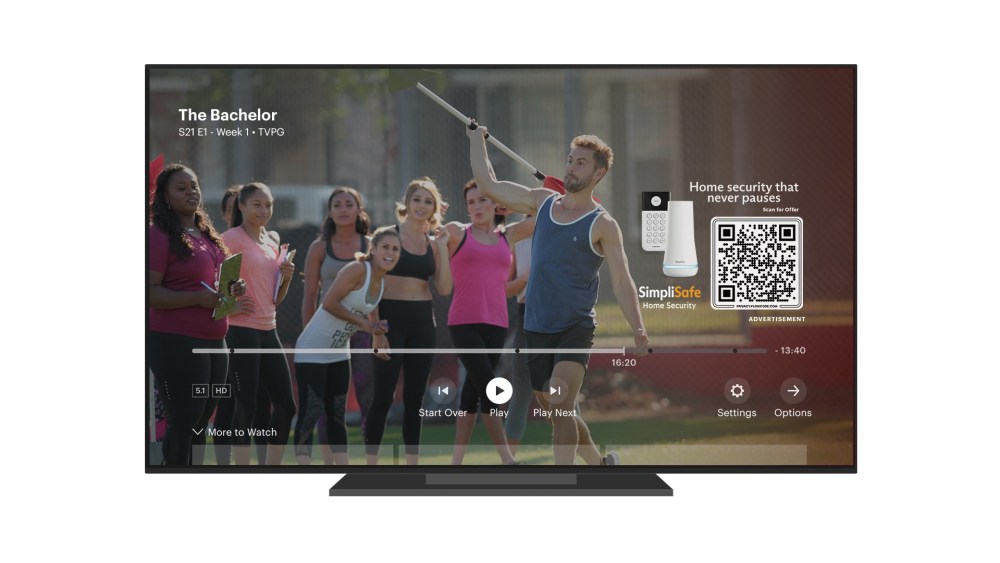

Pause ads, a type of commercial that appears a few seconds after a viewer pauses their streaming content, are becoming more prevalent on platforms like Hulu, Peacock, and Max. As media companies offer cheaper ad-supported versions of their streaming services, pause ads provide an opportunity to generate revenue without overwhelming subscribers with traditional commercials. The challenge lies in finding the right balance between ads and content to avoid user dissatisfaction. Advertisers are eager to tap into the streaming audience, and pause ads offer a non-intrusive way to reach viewers. As technology advances, there is potential for more interactive and engaging pause ad experiences.

Media companies, including Warner Bros. Discovery, are struggling with losses and debt in the streaming era. They have been focused on their content libraries but need to rethink what consumers need. Netflix and Hulu have succeeded by offering a mix of licensed and original content, along with user-friendly interfaces and personalized recommendations.

Streaming platforms are increasingly pursuing Spanish-language sports rights to cater to the growing Hispanic viewership. Media companies like TelevisaUnivision and Canela Media are expanding their sports content, while English-language streamers such as NBCUniversal's Peacock, Disney's ESPN+, and Amazon's Prime Video are adding simulcast content in Spanish. This move aims to diversify viewership and advertising opportunities, as Hispanic audiences spend a significant amount of time consuming media and are at the forefront of cord-cutting. By offering sports content in Spanish, streaming platforms can tap into a younger demographic and personalize ad loads for the Spanish audience, driving subscriber growth and profitability.