Red-State AGs Urge DOJ to Scrutinize Netflix-Warner Bros Merger Over Monopoly Fears

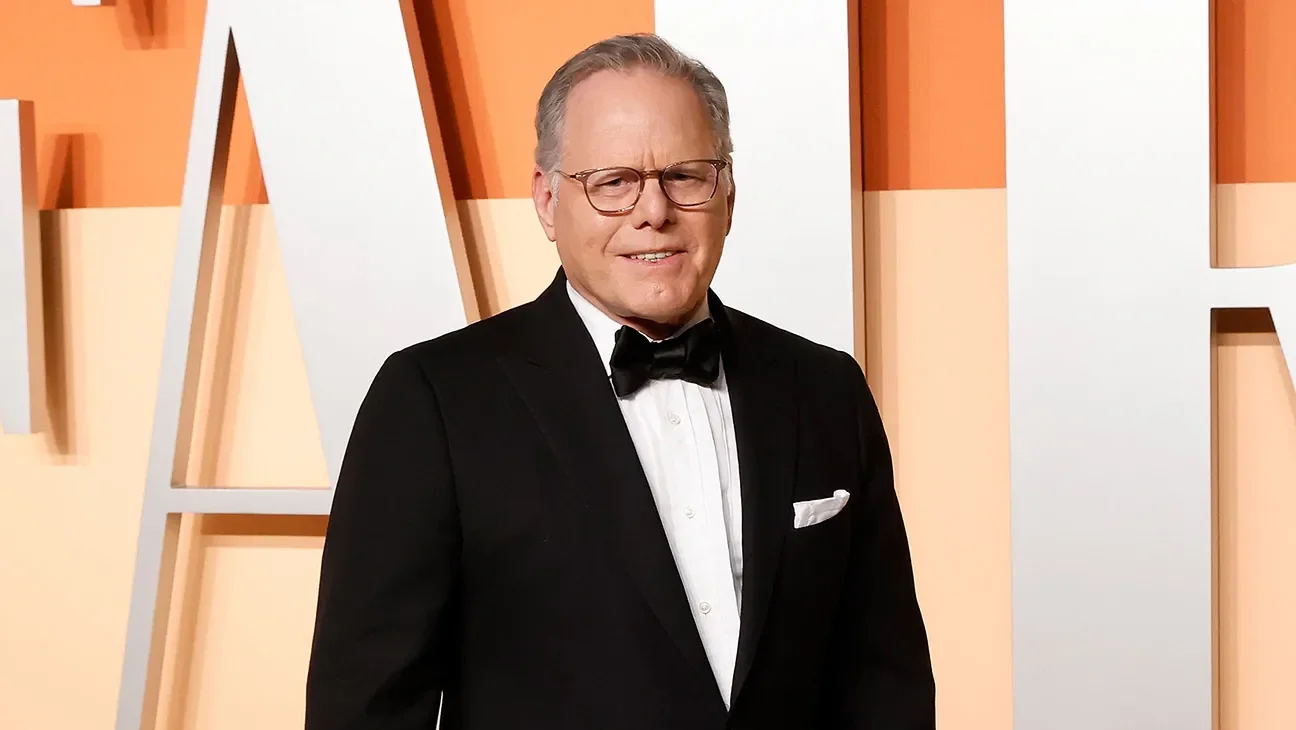

Nearly a dozen Republican state attorneys general are urging the U.S. Department of Justice to subject Netflix’s planned $83 billion acquisition of Warner Bros. Discovery to a thorough Clayton Act review, warning the deal would concentrate market power, raise prices, and curb innovation for American consumers; the DOJ has opened a formal antitrust probe into Netflix’s bid, while Paramount’s Ellison attended the State of the Union and Democrats have their own concerns. Netflix says its competition is YouTube and denies it would monopolize the market, and both Netflix and Paramount declined to comment.