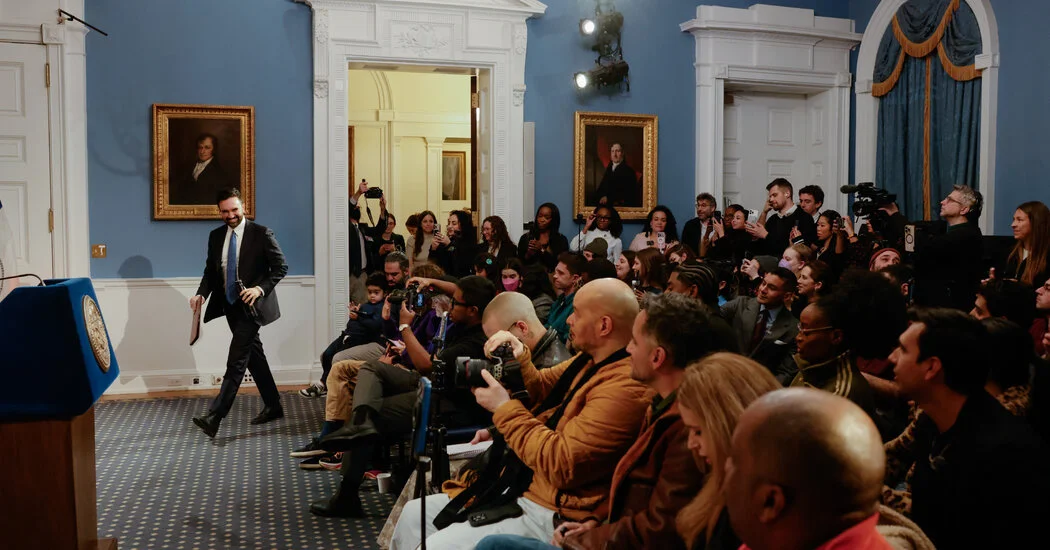

Campaign Glamour Meets City Hall as Mamdani Pushes Rental-Hearings Agenda

In his first week as NYC mayor, Zohran Mamdani blends campaign theater with governing, addressing content creators at City Hall and signaling a policy push with plans for rental 'rip-off' hearings to hold landlords to account, all while his familiar media persona and social-media presence frame his approach to leadership.