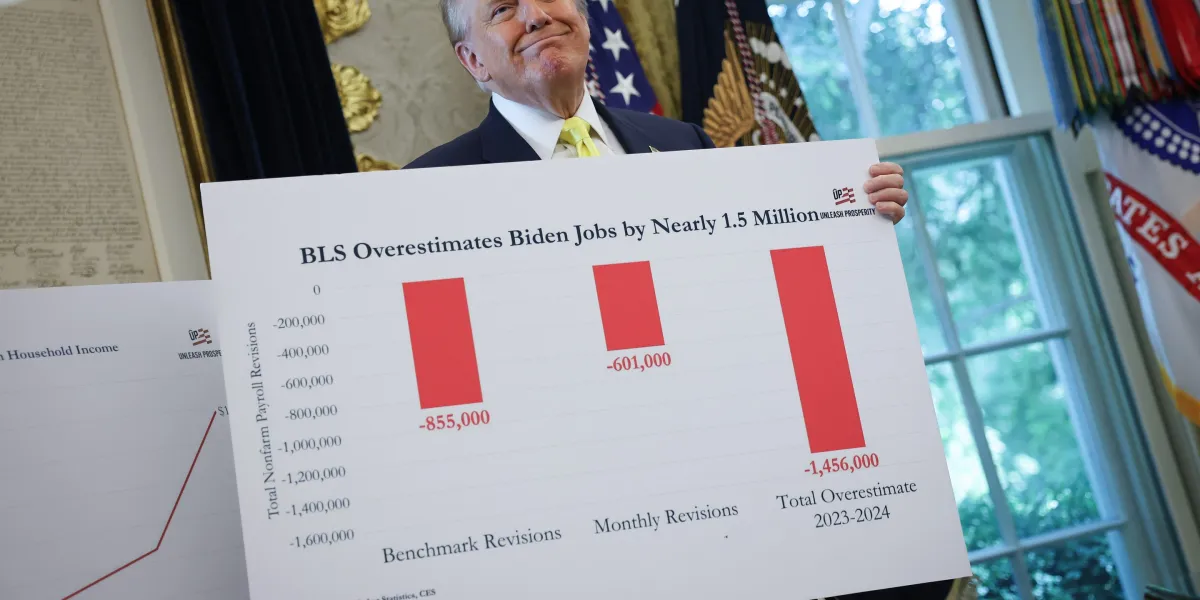

Government Shutdown Delays Jobs Data, Signaling Economic Cooling

The ongoing government shutdown has prevented the release of the official October jobs report, but alternative data suggests the U.S. labor market is experiencing a slowdown with reduced hiring and increased layoffs, though not indicating a recession. Small businesses are particularly cautious, and while some indicators show signs of weakness, overall employment remains relatively stable, influencing Federal Reserve considerations on interest rate policies.