US unemployment claims rise to 231,000 in week ending Jan 31

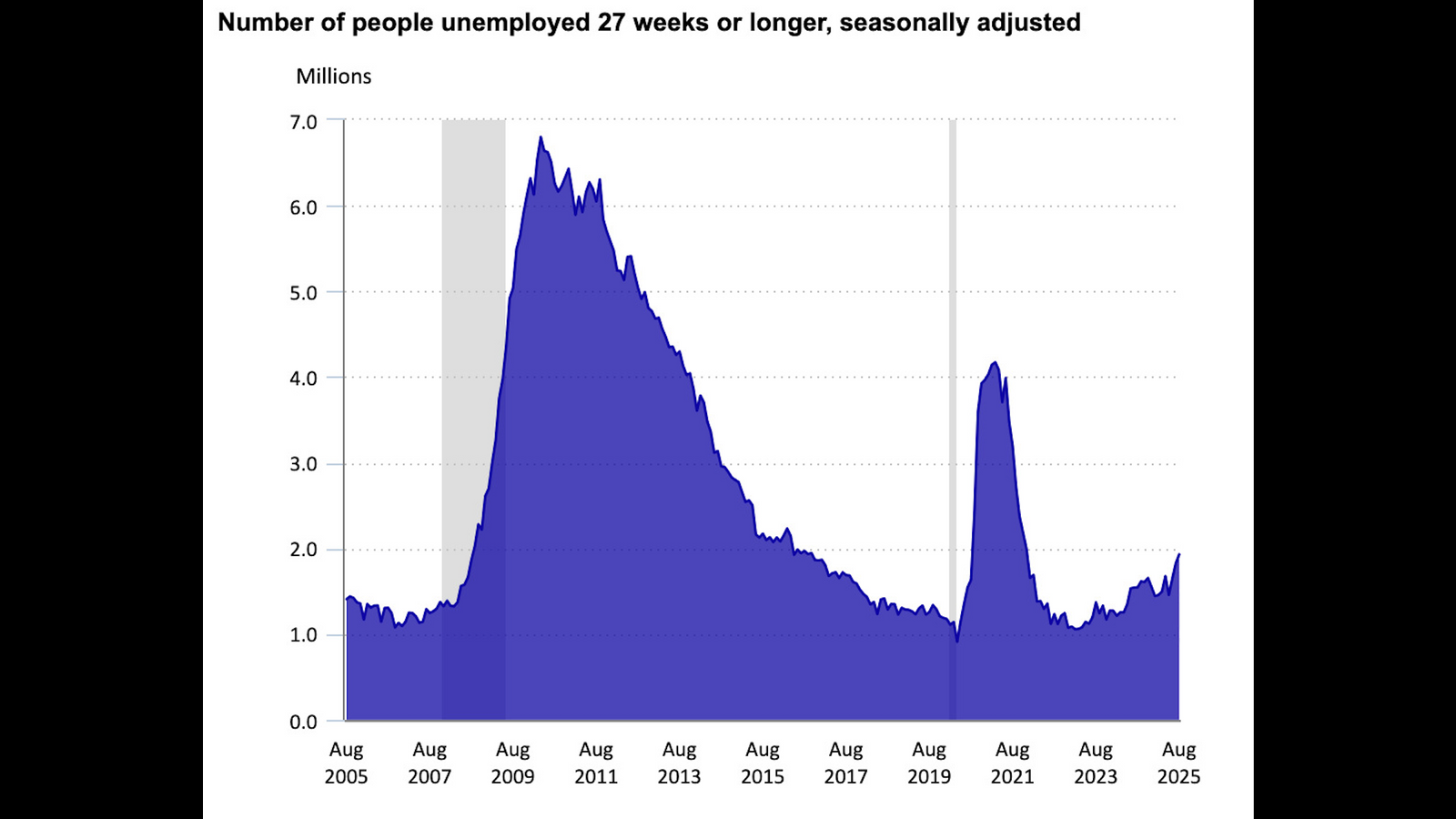

US Labor Department data show seasonally adjusted initial unemployment claims rose to 231,000 in the week ending Jan. 31, up 22,000 from the prior week, with the 4-week moving average at 212,250. The insured unemployment rate held at 1.2% for the week ending Jan. 24, and the number of people receiving unemployment benefits rose to 1,844,000 (up 25,000). The figures indicate a modest uptick in layoffs but remain in a low, historically healthy range.