Japan's Stock Market Reaches Year-End High Amid Mixed Signals

Japanese stocks reached a record high for the year, signaling strong market performance as the year closes.

All articles tagged with #japanese stocks

Japanese stocks reached a record high for the year, signaling strong market performance as the year closes.

Japanese stocks experienced volatility and the yen weakened as Sanae Takaichi won a parliamentary vote to become prime minister, signaling potential for increased fiscal spending and impacting market sentiment amid political and economic uncertainties.

Japanese stocks surged and the yen weakened following Sanae Takaichi's victory in the ruling party race, signaling positive market sentiment and potential policy shifts.

Japanese stocks rise as yen weakens, while the rest of Asia struggles after Wall Street selloff. Dollar strengthens against major peers as yen hits lowest level versus dollar since 1990, sparking speculation that Japan will intervene to stem decline. Nikkei 225 index on track for record closing high.

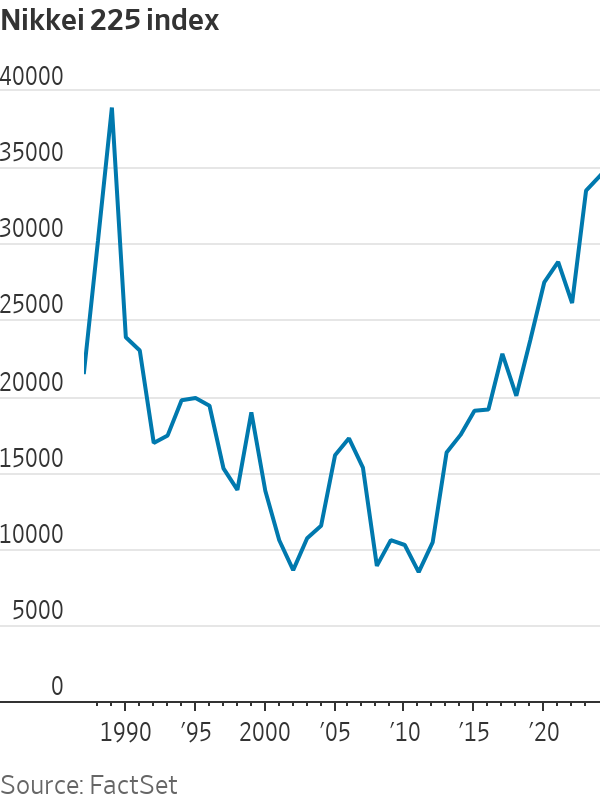

Global markets are reacting to a shift in expectations for Federal Reserve interest rate cuts, with traders now anticipating fewer cuts than previously expected. This change has implications for central banks worldwide, with the Reserve Bank of Australia now expected to make only one rate cut instead of two. The higher U.S. rates outlook may also limit easing from central banks in emerging markets. Meanwhile, Japanese stocks are approaching their 1989 peak, and Indonesians are voting for the country's next leader. Key market-influencing events today include UK inflation figures and Euro zone GDP flash estimates.

Asian stocks rose with Japanese shares leading gains fueled by hype over AI and tech sector optimism, while Chinese markets continued to decline amid fears of a slowing economic recovery. Japanese stocks surged, with the Nikkei hitting a new 34-year high, driven by tech gains and expectations of a dovish BOJ. Asian tech sector buoyed by positive outlook for 2024 from TSMC and AI-fueled demand, countering concerns over higher interest rates. Chinese stocks lagged due to worries about a slowing economic recovery, with the PBOC keeping its benchmark rate on hold. Indian markets were closed for a special holiday, and traders were cautious about potential communal violence related to the inauguration of a temple.

Stock futures are near flat as investors await the producer price index after December's consumer price index came in slightly higher than expected, impacting market sentiment on potential interest rate cuts. Crypto-related shares took a hit following the SEC's approval of a rule change for bitcoin-related ETFs. Major indexes are heading for modest gains this week, with the Dow up 0.7%, S&P 500 up 1.8%, and Nasdaq up over 3%. Japanese stocks are outperforming U.S. stocks, and BlackRock's bitcoin ETF saw over $1 billion worth of trades on its first day. Implied probabilities from interest rate futures trading suggest increased expectations for Fed rate cuts in March, May, and June.

Japanese stocks, led by technology shares and a weaker yen, reached a nearly 34-year high, with the Nikkei Stock Average rising 2% to its highest level since February 1990. Nintendo shares also hit a record high, reflecting strong earnings and anticipation for a new console launch.

Asian stocks, particularly in Japan and Hong Kong, saw gains as investors awaited US inflation data to gauge Federal Reserve policy. Japanese share gauges were set to reach three-decade highs, partly due to the yen's weakness and a new tax-free retirement savings program.

Japanese stocks surged towards a three-decade high, with the Nikkei 225 index jumping over 2% and the Topix index reaching a 34-year peak, while broader market sentiment remained subdued as investors awaited key US inflation data.

Japanese stocks, particularly the Nikkei, have continued their bullish streak, reaching highs not seen since 1990. The Nikkei is up over 8% this month and nearly 29% for the year. Despite this, the broader Topix index still trades at a relatively low price-to-earnings ratio of 14. Japanese companies hold significant internal reserves, with half of listed companies trading below book value and holding 20% more cash than their market cap. Recent earnings results have shown the benefits of a weak yen and the return of pricing power after years of deflation. Rising inflation expectations may prompt households to invest their cash holdings into equities and bonds. Additionally, there are speculations that the Bank of Japan may unwind its easy monetary policy and potentially turn rates positive, which could benefit financial sector stocks.

Japanese stocks have reached a 33-year high, with the Nikkei 225 index closing at 30,670.10 on Monday. The market rally has been attributed in part to Warren Buffett's Berkshire Hathaway, which has been buying Japanese stocks and investing in the country's trading companies.

Warren Buffett stated in an interview with Nikkei that he plans to increase his investments in Japanese stocks, expressing pride in his current holdings in the country's top five trading houses. Berkshire Hathaway had acquired slightly over 5% in each of the trading houses in August 2020 and increased its stakes in November.