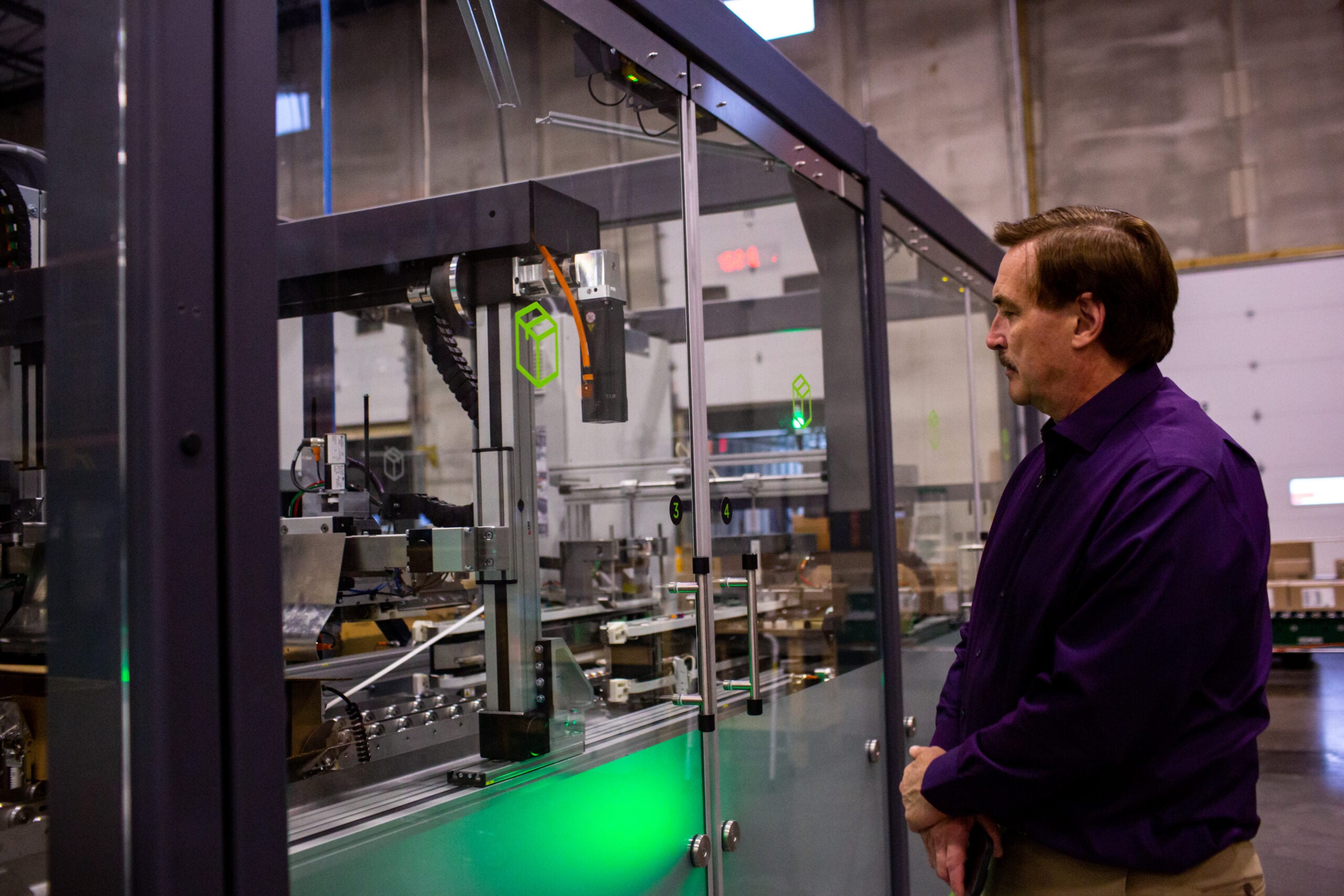

MyPillow Evicted from Minnesota Warehouse Over Unpaid Rent

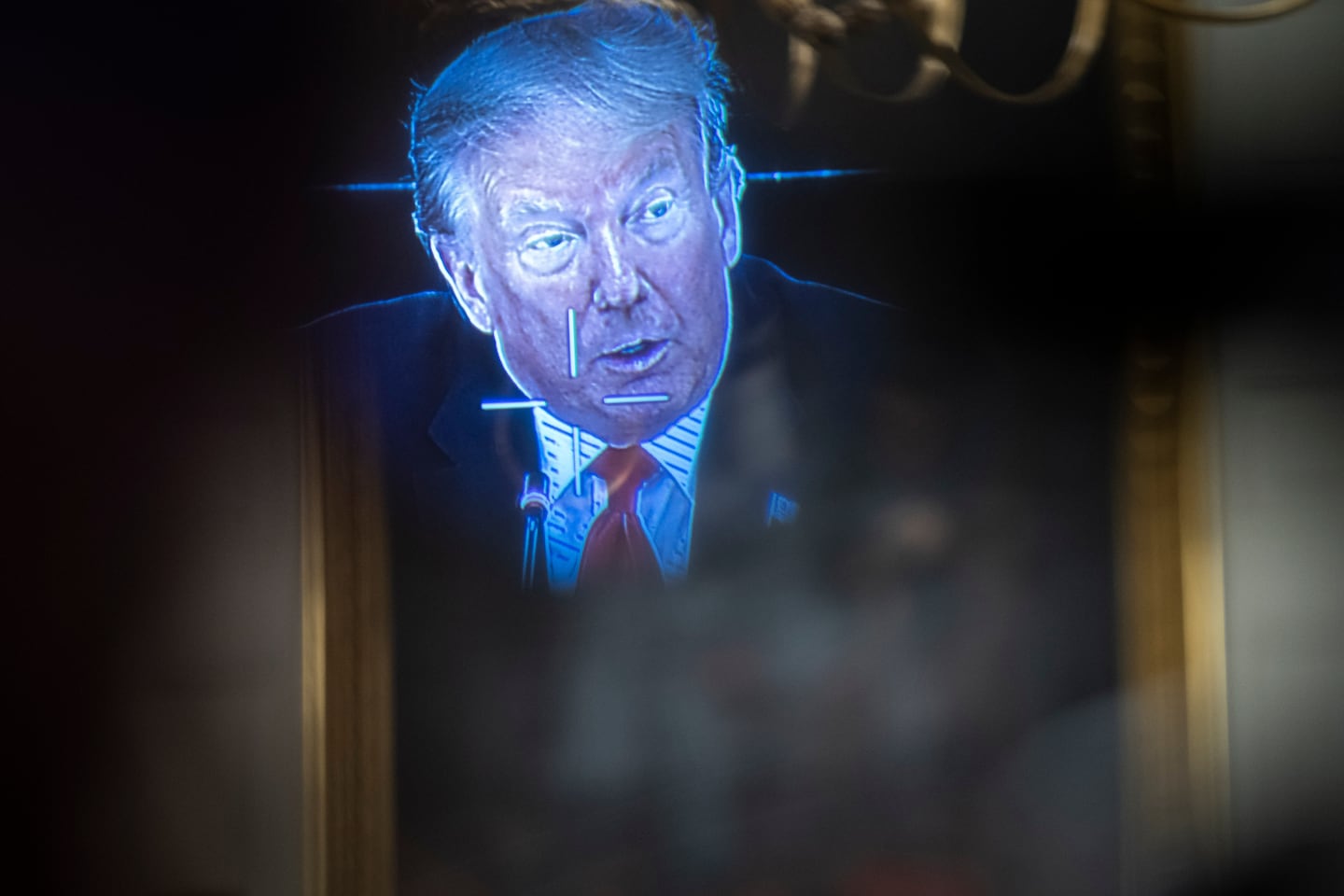

MyPillow is facing eviction from a warehouse in Shakopee due to unpaid rent, but CEO Mike Lindell claims the building has been unused since last fall. The company's financial struggles have been exacerbated by the loss of major retail partners and ongoing legal battles, including defamation lawsuits from Dominion Voting Systems and Smartmatic. Despite these challenges, Lindell remains optimistic about the company's future, stating that they have shifted their focus away from retail and are "coming out the other side."