China's Real Estate Market Faces Sharp Decline Amidst Economic Challenges

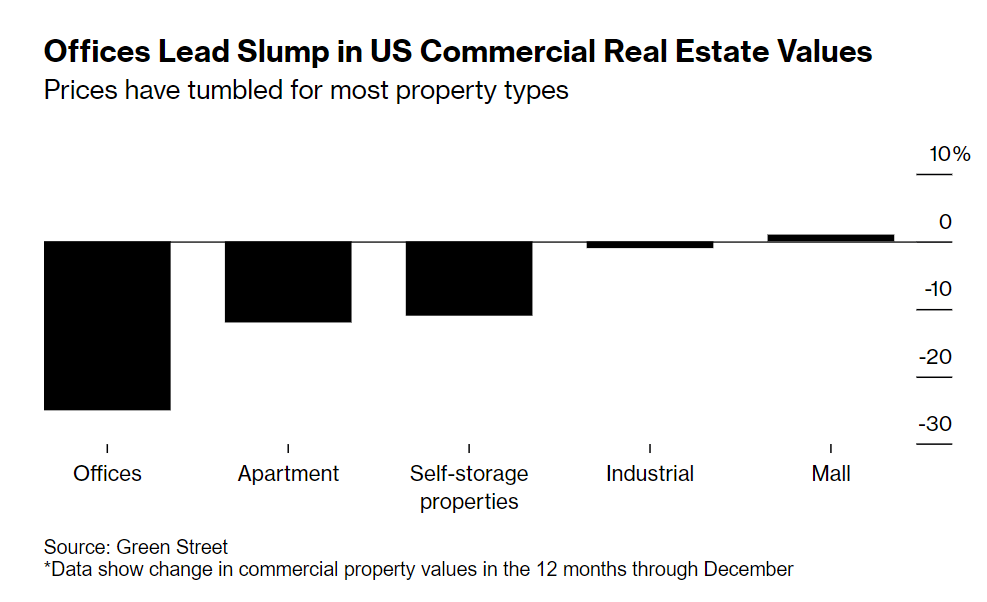

Foreign investors in China's real estate market are facing significant losses due to oversupply, falling property values, and high vacancy rates, leading to distressed sales and potential further market decline, with many assets being sold at steep discounts and some investors walking away from their investments.