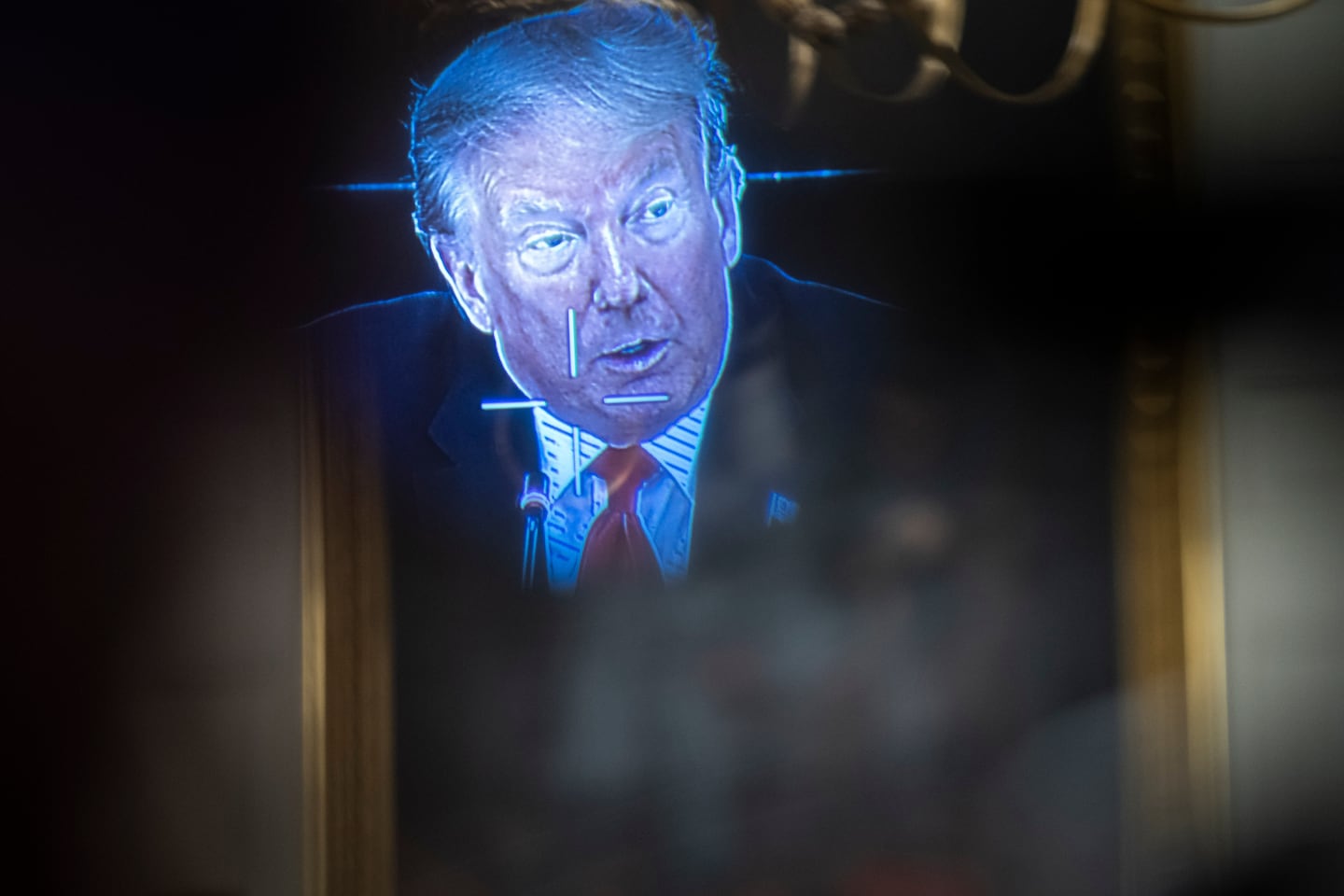

"Trump's Net Worth Soars to $6.4 Billion, Enters Top 500 Richest People Worldwide"

Donald Trump's net worth has surged to $6.4 billion after Digital World Acquisition shareholders voted to merge with his Truth Social platform, making him one of the world's 500 richest people. Despite facing a $175 million court judgment, Trump claims to have nearly $500 million in cash and has 10 days to come up with the amount. The surge in his net worth is attributed to the stock price of the merged company, which will be publicly traded on the NASDAQ. However, restrictions may prevent him from using his stake to pay the judgment, and Forbes estimates his net worth at $2.6 billion.