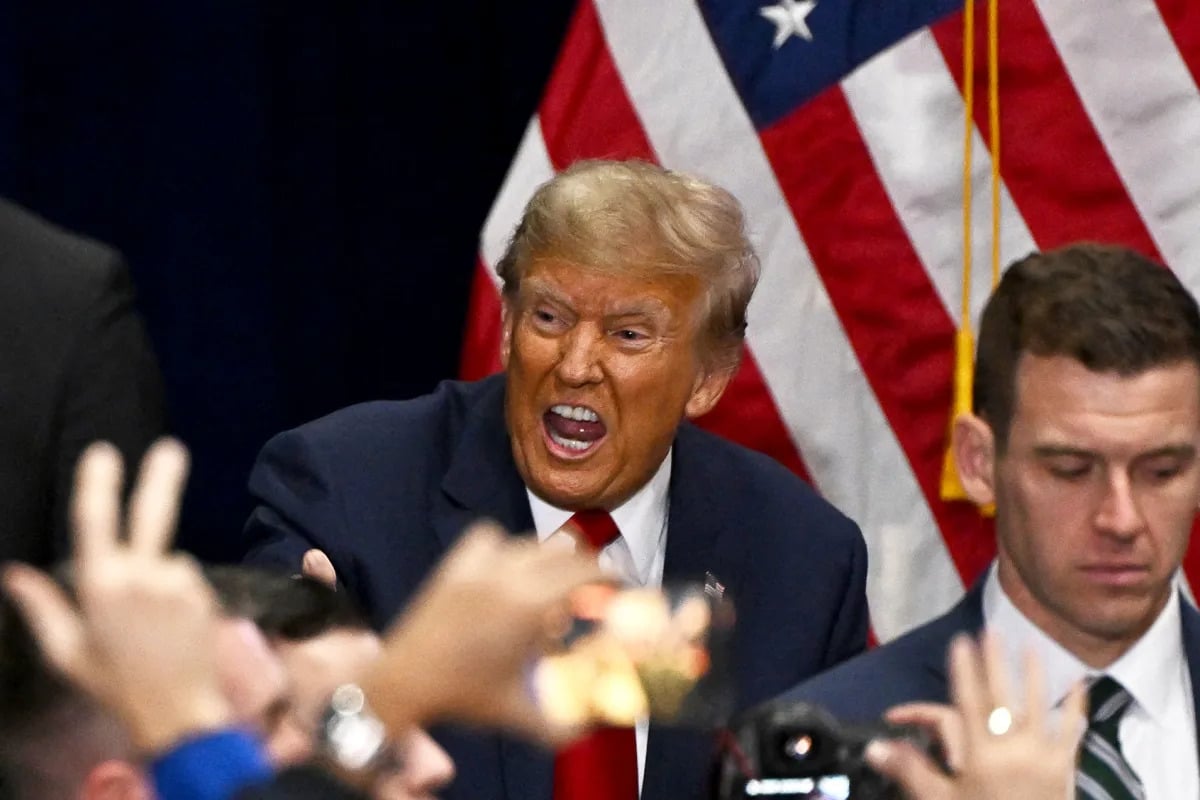

Appeals Court Dismisses $500M Civil Fraud Penalty Against Trump

A New York appeals court has overturned a nearly half-billion-dollar financial penalty against Donald Trump related to civil fraud, while still affirming that he engaged in fraud by exaggerating his wealth, and has imposed a temporary ban on him and his sons from corporate leadership roles. The ruling highlights a divided judicial opinion on the severity of the penalties and the merits of the fraud findings, with ongoing legal and political implications.