Legalfinancial News

The latest legalfinancial stories, summarized by AI

Featured Legalfinancial Stories

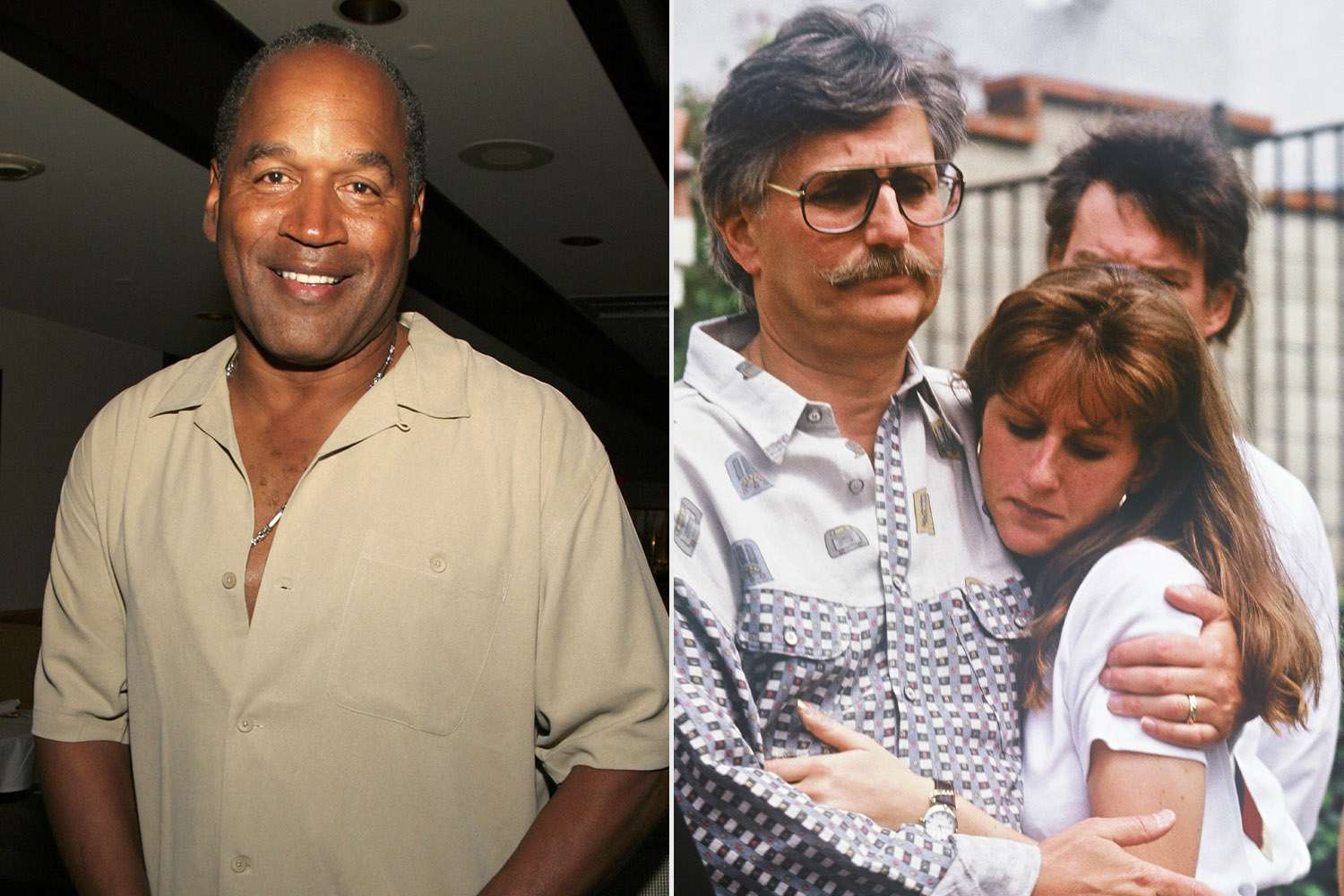

"The Lingering Impact of O.J. Simpson's Legacy and Debt"

O.J. Simpson, who died in April, reportedly owed the Goldman family over $100 million from a wrongful death lawsuit dating back to 1997, with interest causing the debt to balloon to $114 million. Despite previous attempts to collect, the family has not received the money owed, and legal battles loom as they seek to determine how Simpson's assets will be distributed after his death.

More Legalfinancial Stories

"New York Attorney General Casts Doubt on Trump's $175M Bond Deal"

New York Attorney General Letitia James has raised doubts about the $175m bond posted by Donald Trump in his civil fraud case, questioning whether the California-based insurer, Knight Specialty Insurance Company, has the financial capacity to cover it. The insurer's lack of authorization to issue surety bonds in New York has prompted the attorney general to request further proof of its capital. Meanwhile, Trump's legal team has refuted the attorney general's concerns, and the judge overseeing the case has scheduled a hearing on the matter for April 22.

"Judge Allows Rudy Giuliani to Keep Florida Condo Despite Spending Concerns"

A New York bankruptcy judge declined to rule on a motion to force Rudy Giuliani to sell his $3.5 million Florida condo, despite concerns about his spending habits and the significant amount of money he has put into the property since declaring bankruptcy in December. Giuliani's diverse coalition of creditors, including a supermarket employee, elections technology companies, and the IRS, are seeking payment. The judge hinted at potential "draconian" measures if Giuliani does not comply with information requests about his spending habits, with the next hearing scheduled for May 14th.

"New York AG Challenges Validity of Trump's $175M Bond Deal"

New York Attorney General Letitia James questions the financial stability of Knight Specialty Insurance Company, which posted a $175 million bond for Donald Trump in his bank fraud case. The AG has raised concerns about the company's ability to operate in the state and meet capital requirements, as well as its over-leveraging. Knight Specialty Insurance Company's president claims the firm is not subject to New York's solvency rules, but this assertion has raised further questions. The company's financial statements and its ability to cover the bond amount have come under scrutiny, leading to doubts about its capacity to handle the risk.

"Trump's Financial Maneuvers: From Hush Money Trials to Billionaire Backers"

Don Hankey's financial company, Westlake Services, settled with Trump's DOJ after illegally repossessing cars belonging to military employees, violating the Servicemembers Civil Relief Act. The settlement involved paying $700,000 in damages to affected servicemembers and a $61,000 fine to the federal government. This history is important context for Hankey's recent $175 million bond backing for Trump, who is appealing a $450 million civil judgment against him.

"Trump Posts $175 Million Bond to Appeal Civil Fraud Verdict"

Donald Trump has posted a $175 million bond in his New York civil fraud case, preventing the state from seizing his assets while he appeals the more than $454 million he owes. The bond is a placeholder to guarantee payment if the judgment is upheld, and if Trump wins, he won’t have to pay the state anything. The bond was posted after a New York appellate court lowered the required amount, and the underwriter for the bond is Knight Specialty Insurance. Trump is fighting to overturn a judge’s finding that he lied about his wealth, and the appeals court is set to hear arguments in September.

"Baltimore Bridge Collapse: Liability Cap Claimed Amid Economic Impact"

Singaporean companies involved in the Baltimore bridge collapse have filed a petition to limit their liability to $43.6 million under an 1851 maritime law, citing the vessel's value and incurred expenses. The incident, which closed the Port of Baltimore, could result in insured losses of $2-4 billion, making it potentially the costliest marine loss in history. The legal process is expected to take years, with the focus on determining the cause of the catastrophe. The collapse has resulted in casualties, with families potentially seeking compensation under maritime law for wrongful death claims.

"Texas Judge Halts Revised Fair Lending Regulations"

A federal judge in Texas has blocked the enforcement of new regulations aimed at overhauling how lenders extend loans and services to low- and moderate-income Americans, finding that the rules violated the Community Reinvestment Act of 1977. The judge's preliminary injunction, issued in response to a lawsuit by banking and business groups, prevents the rules from taking effect. The updated regulations, issued by the Federal Reserve, Federal Deposit Insurance Corporation, and Office of the Comptroller of the Currency, sought to broaden the geographies in which lenders are required to extend services, but the judge ruled that they exceeded the authority granted by the 1977 law.

"Trump Faces Imminent $454 Million Bond Deadline in Fraud Case"

Former President Donald Trump faces a deadline to block the New York attorney general from collecting a $454 million judgment in a civil fraud case accusing him of inflating his net worth. If no one posts a bond guaranteeing his financial obligation, the attorney general can start seizing his accounts and properties, potentially starving his family business of cash and ending his New York mogul status. Trump must find a company willing to post a half-billion dollar bond on his behalf to avoid a humiliating outcome.

"Trump Faces Seizure Threat as $454 Million Judgment Deadline Looms"

Donald Trump faces a Monday deadline to cover a $454 million civil fraud judgment or risk New York state seizing some of his properties, including Trump Tower and 40 Wall Street. Trump must either pay the money or post a bond while he appeals the judgment. The case, brought by New York Attorney General Letitia James, alleges Trump manipulated his net worth and property values to deceive lenders and insurers. Trump's financial worries also include lagging campaign fundraising and other legal challenges, including criminal charges.

"Trump's High-Stakes Battle: The $464m Bond and New York Property Seizure"

Donald Trump faces a financial crisis as he struggles to secure a $464m bond after losing a civil fraud trial in New York, with 30 companies unwilling to help. His legal team is seeking to block enforcement while he appeals, but the companies are hesitant due to the large bond size and risk associated with his properties. New York Attorney General Letitia James is prepared to target his assets to collect the $464m judgment, and Trump's legal battles raise questions about his finances and fundraising efforts for his legal fees and potential presidential campaign.