China and Japan in New Tensions Over Rare Earths and Trade

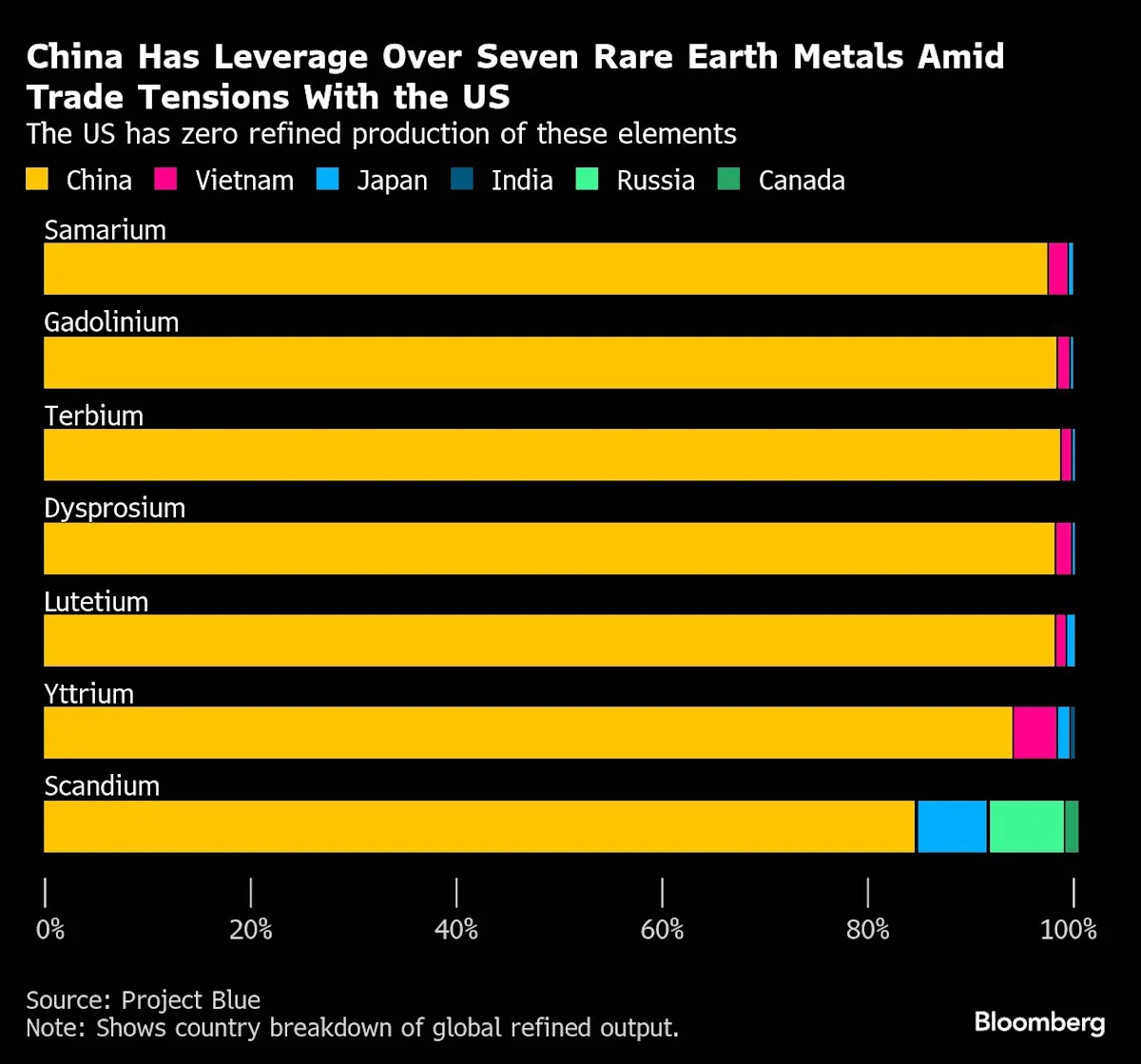

China has imposed restrictions on exports to Japan, including potential controls on rare earths, escalating tensions amid Japan's military and economic activities, with broader implications for regional stability and global supply chains.