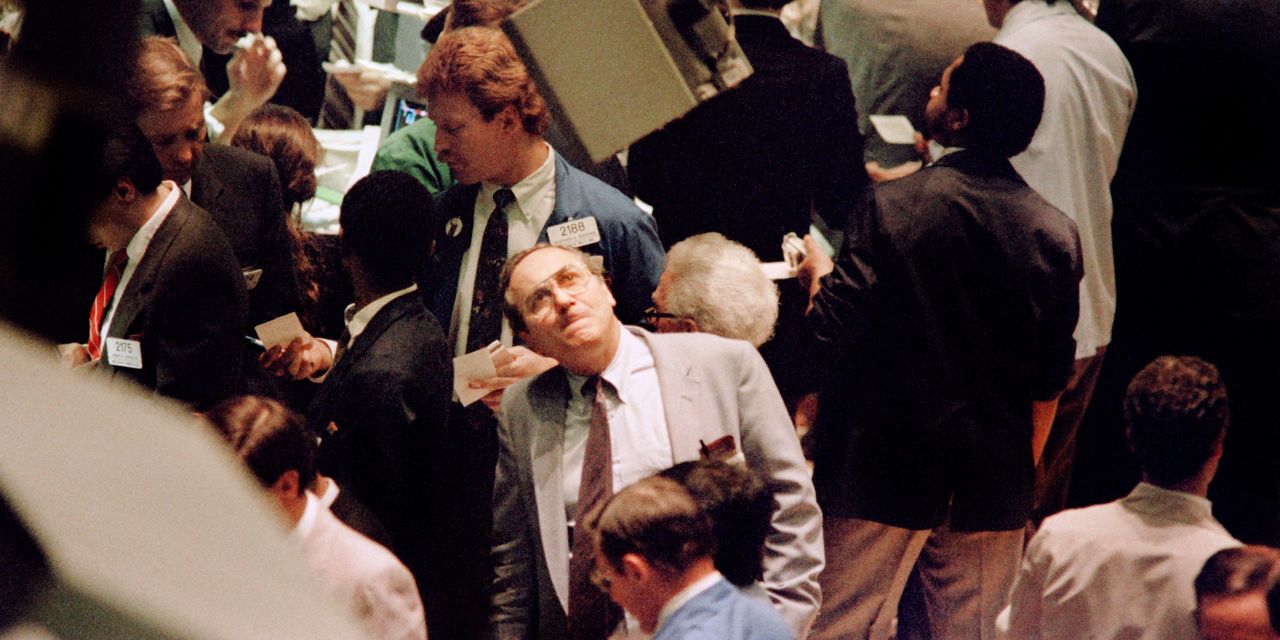

Wall Street CEOs Caution on Market Decline Due to High Valuations

Wall Street CEOs warn of a potential market pullback of over 10% in the next 12 to 24 months, citing high valuations and geopolitical risks, but see such corrections as normal and healthy for market cycles, encouraging investors to stay the course and reassess portfolios.